Top Class Actions readers received payments of up to $3,600 from settlements with Freedom Financial, 20/20 Eye Care Network, Smile Brands and other companies.

Freedom Financial TCPA settlement checks

Our viewers reportedly received payments from a $9.75 million settlement with Freedom Financial Network, resolving claims the debt relief company violated federal law with unsolicited robocalls.

The settlement benefits individuals who received robocalls between May 17, 2017, and April 17, 2018, that used an artificial or prerecorded voice to sell Freedom Financial Network or Freedom Debt Relief products.

According to the class action lawsuit, Freedom Financial violated the federal Telephone Consumer Protection Act (TCPA) by contacting consumers with unsolicited robocalls. Under TCPA, businesses must get consumer consent before contacting them with robocalls or prerecorded calls.

Freedom Financial agreed to pay $9.75 million to resolve the TCPA class action lawsuit. Under the terms of the settlement, consumers could receive a cash payment with larger payments going to consumers whose numbers were on the Do Not Call Registry. Top Class Actions viewers report receiving payments of up to $233.55 from this settlement.

The deadline to submit a claim with the settlement was Nov. 25, 2023.

The Freedom Financial TCPA class action lawsuit is Berman, et al. v. Freedom Financial Network LLC, et al., Case No. 4:18-cv-01060 in the U.S. District Court for the Northern District of California.

Woopla virtual currency class action rebates

Top Class Actions readers received electronic payments and settlement checks from a $835,000 settlement with Woopla that resolved claims it violated Kentucky gambling laws.

The settlement benefits Kentucky residents who spent $5 or more within a 24-hour period on funzpoints.com between June 27, 2018, and Oct. 29, 2022.

Plaintiffs in the class action lawsuit claim Woopla violated Kentucky gambling laws by requiring consumers to purchase in-game currency to gamble on its websites. According to the class action lawsuit, this in-game currency allowed consumers to gamble with real money despite state laws prohibiting online gambling.

Woopla agreed to pay $835,000 to resolve the gambling class action lawsuit. Under the terms of the settlement, consumers could receive a cash payment based on the amount they paid for in-game purchases. Our readers received electronic payments and checks of up to $3,600 from the virtual currency class action lawsuit settlement.

The deadline to submit a claim with the settlement was Jan. 29, 2024.

The Woopla virtual currency class action lawsuit is Wyland v. Woopla Inc., Case No. 2023-CI-00356, in the Kentucky Circuit Court for Henderson County.

Ford antitrust settlement checks

California auto purchasers reportedly started to receive payments from an $82 million antitrust class action lawsuit settlement with Ford Canada.

The settlement benefits consumers who purchased Acura, Buick, Cadillac, Chevrolet, Chrysler, Dodge, Ford, GMC, Honda, Hummer, Infiniti, Jaguar, Jeep, Land Rover, Lexus, Lincoln, Mazda, Mercury, Nissan, Oldsmobile, Plymouth, Pontiac, Saab, Saturn, Toyota or Volvo vehicles from a California dealer between Jan. 1, 2001, and April 30, 2003.

According to the antitrust class action lawsuit, Ford Canada conspired with other automotive companies to prevent the exportation of new vehicles to the United States. This scheme allegedly caused Californians to overpay for new vehicles.

Ford Canada agreed to pay $82 million to resolve the antitrust class action lawsuit. Consumers could receive a payment based on their vehicle details and whether they leased or purchased their vehicles. One Top Class Actions viewer reports receiving a payment of $88.82 from this settlement.

The deadline to submit a claim with the settlement was Dec. 31, 2022.

The Ford antitrust class action lawsuit is Automobile Antitrust Cases I and II, JCCP Nos. 4298 and 4303, in the Superior Court for the City and County of San Francisco.

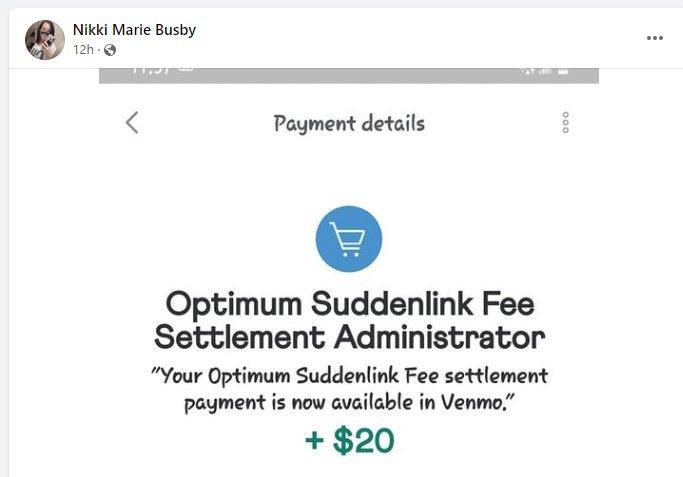

Optimum, Suddenlink fees class action rebates

Top Class Actions viewers reportedly started to receive payments from a $15 million class action lawsuit settlement with Optimum and Suddenlink, resolving claims they charged hidden fees to increase monthly rates.

The settlement benefits Optimum and Suddenlink customers who were charged certain fees between July 27, 2018, and May 5, 2023.

Plaintiffs in the class action lawsuit claim Optimum and Suddenlink used hidden fees to charge higher monthly costs for internet and cable services. These fees allegedly allowed the companies to charge more than they promised in various promotions.

Altice, Optimum and Suddenlink’s parent company, agreed to pay $15 million to resolve the internet fees class action lawsuit. Consumers could receive a cash payment based on the amount they paid in fees and whether they were current customers. Our readers received electronic payments of up to $20 from the fees class action lawsuit settlement.

The deadline to submit a claim with the settlement was Sept. 5, 2023.

The Optimu, Suddenlink fees class action lawsuit is Seale, et al. v. Altice USA Inc., et al., Case No. MER-L-618-23, in the New Jersey Superior Court for Mercer County.

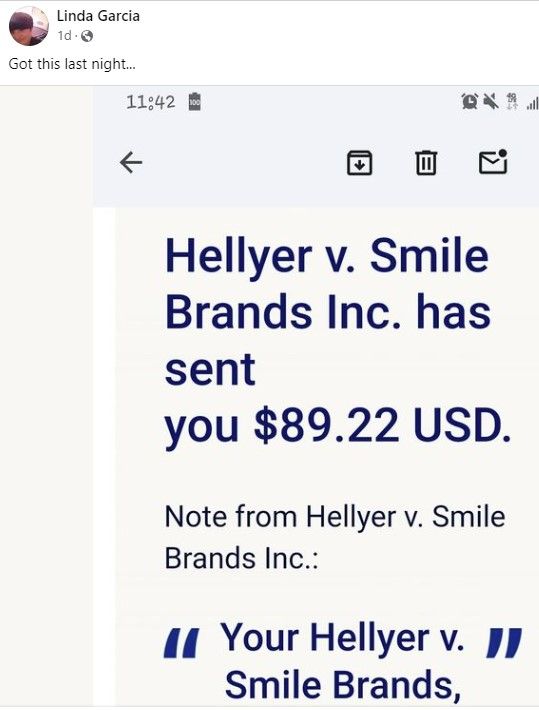

Smile Brands data breach settlement checks

Our readers reportedly began to receive payments from a data breach class action lawsuit settlement with Smile Brands.

The settlement benefits dental patients who received a written notice from Smile Brands or a Smile-affiliated dental practice informing them of the 2021 data breach.

According to the data breach class action lawsuit, Smile Brands failed to prevent a 2021 data breach that compromised the sensitive information of around 1.5 million patients. Plaintiffs in the case argue Smile Brands could have prevented the data breach by implementing reasonable cybersecurity measures.

Smile Brands agreed to a settlement to resolve the data breach class action lawsuit. Claimants could receive up to $5,000 for data breach-related losses. One Top Class Actions viewer reports receiving an electronic payment of $89.22 from this settlement.

The deadline to submit a claim with the settlement was Nov. 16, 2023.

The Smile Brands data breach class action lawsuit is Hellyer v. Smile Brands Inc., Case No. 8:21-cv-01886-DOC-ADS, in the U.S. District Court for the Central District of California.

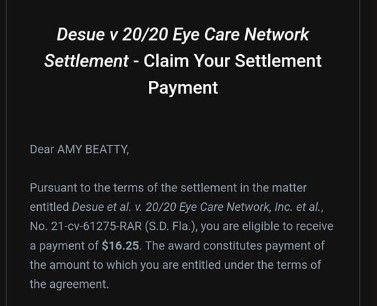

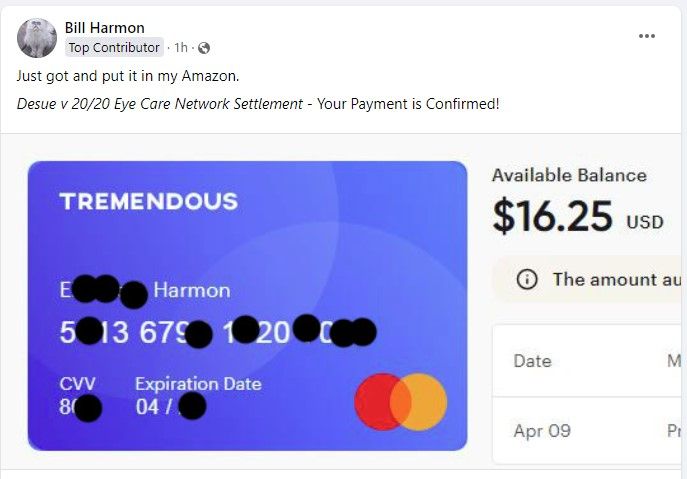

20/20 Eye Care data breach class action rebates

Vision and hearing patients started to receive payments from a $3 million data breach class action lawsuit settlement with 20/20 Eye Care Network and 20/20 Hearing Care Network.

The settlement benefits individuals who received a data breach notification from 20/20 Eye Care Network or 20/20 Hearing Care Network as a result of the data breach that occurred in January 2021.

20/20 Hearing Care Network and 20/20 Eye Care Network allegedly failed to protect patients from a January 2021 data breach that compromised patient information. Plaintiffs in the data breach class action lawsuit claim the companies should have better protected consumer information by implementing reasonable cybersecurity measures.

The companies agreed to pay $3 million to resolve the data breach class action lawsuit. Consumers could receive up to $2,500 in reimbursement for data breach expenses, along with various other benefits. Our readers received electronic payments of $16.25 from the data breach class action lawsuit settlement.

The deadline to submit a claim with the settlement was May 1, 2023.

The 20/20 Eye Care data breach class action lawsuit is Desue, et al. v. 20/20 Eye Care Network Inc., et al., Case No. 0:21-cv-61275-RAR, in the U.S. District Court for the Southern District of Florida.

Don’t Miss Out!

Check out our list of Class Action Lawsuits and Class Action Settlements you may qualify to join!

Read About More Class Action Lawsuits & Class Action Settlements:

One thought on Settlement checks in the mail for Freedom Financial, Ford, Optimum, others

Yes I need help looking into a class action settlement please