Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

Top Class Actions readers received settlement payments of up to $1,500 from a number of class action lawsuits.

Equifax data breach class action rebates

Equifax agreed to pay $380.5 million to resolve claims a 2017 data breach exposed the information of 147 million people in the United States.

The settlement benefits consumers affected by the 2017 Equifax data breach.

Plaintiffs in the Equifax class action lawsuit accused the credit bureau of failing to protect their information. According to the class action, Equifax could have prevented or mitigated the data breach through reasonable cybersecurity measures.

Equifax agreed to pay at least $380.5 million to resolve these allegations. The settlement offered free credit monitoring or a cash payment in addition to up to $20,000 in expense reimbursement. Top Class Actions viewers report settlement payments of up to $22.82.

In order to receive a settlement payment, Class Members had to submit a valid claim form by Jan 22, 2020.

The Equifax data breach class action lawsuit is In re: Equifax Inc. Customer Data Security Breach Litigation, Case No. 1:17-md-2800-TWT, in the U.S. District Court for the Northern District of Georgia.

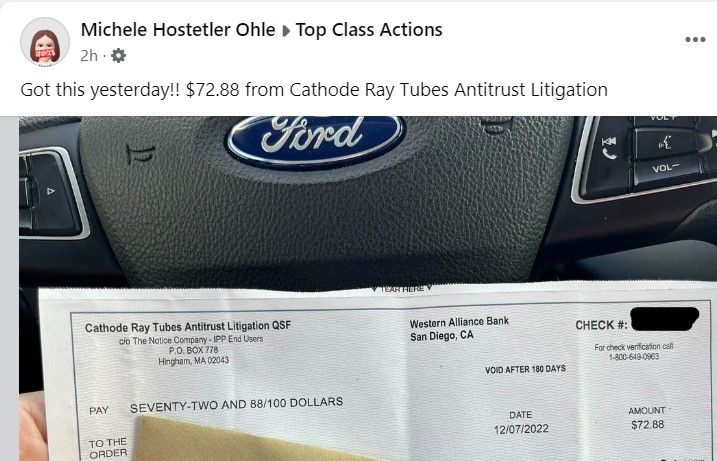

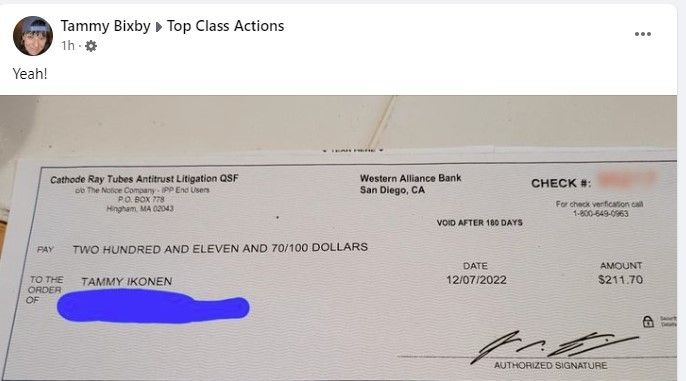

CRT indirect purchaser settlement checks

LG and Chunghwa agreed to a class action settlement to resolve claims they conspired to raise the price of cathode ray tube (CRT) products.

The settlement benefits consumers who purchased televisions, computer monitors or other products with CRTs during various periods between March 1, 1995, and Nov. 25, 2007.

According to the price-fixing class action lawsuit, LG and Chunghwa conspired with other manufacturers to charge more for CRT products. These practices allegedly caused consumers to pay a higher price for the products in violation of federal antitrust laws.

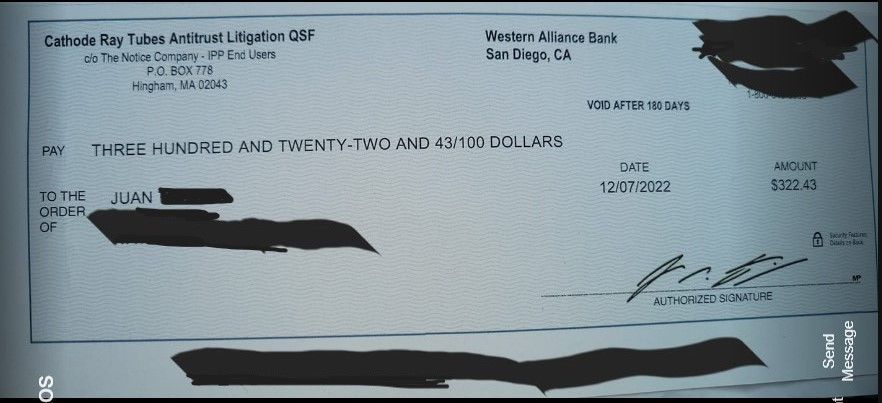

Under the terms of the settlement, consumers could receive an equal share of the net settlement fund based on the products purchased — estimated to be at least $25. Actual payments from the settlement ranged from $63.71 to $322.43, according to TCA readers.

The deadline to submit a claim and receive payment from the class action settlement was June 30, 2016.

The CRT antitrust class action lawsuit is In re: Cathode Ray Tube (CRT) Antitrust Litigation, Case No. 07-cv-05944-SC, MDL No. 1917, in the U.S. District Court for the Northern District of California.

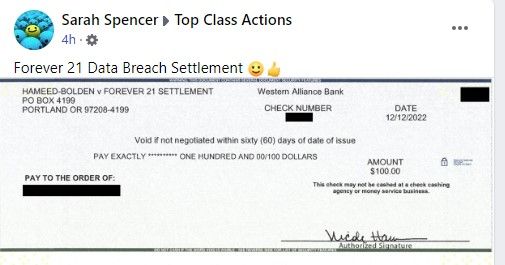

Forever 21 data breach class action rebates

Forever 21 agreed to a data breach class action settlement to resolve allegations that payment card information was stolen from its systems in 2017.

The settlement benefits consumers who used a payment card to make an in-store purchase at certain at-risk Forever 21 stores.

Plaintiffs in the data breach class action lawsuit accuse Forever 21 of failing to safeguard their sensitive payment information. Consumers argue the retailer breached its implied contract with consumers by failing to keep their payment data private.

Forever 21 agreed to pay an undisclosed sum to resolve these allegations. The class action settlement offered payments for expense reimbursement to affected consumers. Top Class Actions readers report receiving payments of $100 from the settlement.

In order to receive a settlement payment, consumers had to submit a valid claim form by March 21, 2022.

The Forever 21 data breach class action lawsuit is Hameed-Bolden, et al. v. Forever 21 Retail Inc., et al., Case No.: 2:18-cv-03019, in the U.S. District Court for the Central District of California.

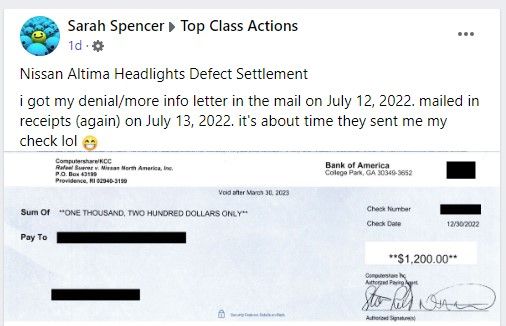

Nissan headlights settlement checks

Nissan Altima owners are receiving payments from a class action settlement resolving claims that the vehicles were manufactured with defective halogen headlights.

The settlement benefits U.S. consumers who purchased or leased a 2013 to 2018 Nissan Altima manufactured with halogen headlights.

According to the class action lawsuit, Nissan Altima halogen headlights were defective and could become delaminated. This allegedly caused dimmer light from low beams and other issues.

Nissan agreed to a class action settlement to resolve these allegations. Under the terms of the settlement, consumers could receive a warranty extension for future repairs and reimbursement for past repairs. One Top Class Actions reader received $1,200 from this settlement.

To receive settlement benefits, consumers had to submit a claim form by April 25, 2022.

The Nissan headlight class action lawsuit is Rafael Suarez, et al. v. Nissan North America, Inc., Case No.3:21-cv-00393-WLC-AN, in the U.S. District Court for the Middle District of Tennessee, Nashville Division.

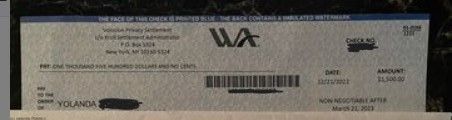

Volusion data breach class action rebates

Volusion LLC agreed to pay $4.3 million to resolve claims it failed to adequately respond to a 2019 data breach.

The settlement benefits consumers who received a data breach notice from Volusion in or around April 2020.

Plaintiffs in the data breach class action lawsuit claim that Volusion did not respond to the October 2019 data breach in a timely fashion. The plaintiffs also accused the company of failing to protect their data.

Volusion agreed to a $4.3 million class action settlement to resolve these allegations. Under the terms of the settlement, consumers could receive reimbursement for data breach losses. A Top Class Actions reader received a $1,500 settlement check from this deal!

In order to receive Volusion class action settlement payments, consumers had to submit a valid claim form by Sept. 6, 2022.

The Volusion data breach class action lawsuit is Lopez, et al. v. Volusion LLC, Case No. 1:20-cv-00761-LY, in the U.S. District Court for the Western District of Texas, Austin Division.

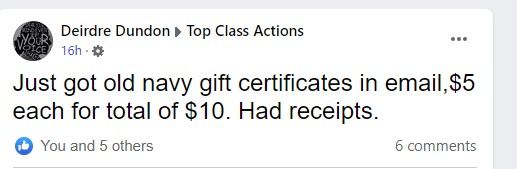

Old Navy pricing settlement checks

Consumers may start receiving checks from an Old Navy false sale class action settlement resolving claims the retailer used misleading reference prices.

The settlement benefits consumers who made purchases from Old Navy in-store or online between Nov. 12, 2015, and Dec. 2, 2021.

According to the false sale class action lawsuit, Old Navy used misleading reference prices to advertise its products. These prices allegedly misled consumers into believing they were getting a good deal on products.

Old Navy agreed to a class action settlement to resolve these claims. The settlement provided settlement purchase certificates. Readers report receiving multiple $5 from the settlement, for total benefits of up to $10.

Consumers had to submit a valid claim form by May 31, 2022, to receive settlement benefits.

The Old Navy fake sale class action lawsuit is Barba, et al. v. Old Navy, et al., Case No. CGC 19-581937 in the Superior Court of the State of California in the County of San Francisco.

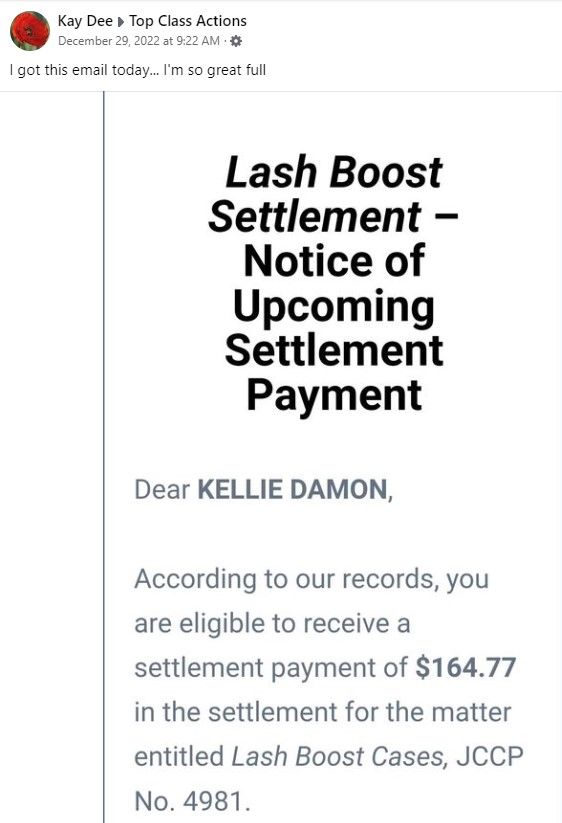

Rodan + Fields Lash Boost class action rebates

Rodan + Fields agreed to pay $38 million to resolve claims its Lash Boost was an unlicensed drug that can cause serious side effects.

The settlement benefits consumers who purchased Rodan + Fields Lash Boost between Oct. 1, 2016, and March 11, 2022.

Plaintiffs in the Lash Boost class action lawsuit argued that the lash serum contained a glaucoma drug that could cause serious side effects if misused. Consumers contend the U.S. Food and Drug Administration should regulate Lash Boost as a drug because of its ingredients.

Rodan + Fields agreed to a $38 million class action settlement to resolve these claims. Under the terms of the settlement, consumers could receive a cash payment of up to $175 or a credit voucher worth up to $250. Top Class Actions readers reported cash class action settlement payments of $164.77.

In order to receive settlement benefits, consumers had to submit a valid claim form by Sept. 7, 2022.

The Rodan + Fields Lash Boost class action lawsuit is Scherr, et al. v. Rodan & Fields, Case No. CIVDS 1723435, in the Superior Court of California, County of San Francisco.

Don’t Miss Out!

Check out our list of Class Action Lawsuits and Class Action Settlements you may qualify to join!

Read About More Class Action Lawsuits & Class Action Settlements:

63 thoughts onOld Navy, Nissan, Equifax, other class action settlement payments in the mail

Add me

Hello I have filed for jdbyrider 2016 I have not. Heard nothing from that or from TransUnion Equifax they should at least a letter or something it would be nice Thank you Elizabeth storm

Add Me

We bought a Nissan in 2017 I shop at the stores.

It should be mandatory for settlement administrators to send notice if a claim is denied and for what reason. I am a victim of the Equifax data breach and filed timely claim for time lost and OP expenses and have received nothing. They also should be required to send updates to claimants if settlement gets appealed holding up settlement payments. Perhaps Top Class Action could add a section to their site or newsletter for such cases where appeals hinder the entire class from getting restitution in a timely manner. Appeals should be filed and ruled upon BEFORE the settlement is reached and notices go out as it wastes a lot of class members time digging up receipts and filling out claim forms.

Also, these data breach and other settlements where the offender sends a claim ID and notice to the victim based on their records (which have been hacked) is not right and people move and can only get their mail forwarded for a year. How many people don’t get the notice with their claim ID because they moved. Also, who really knows who their info and data has been sold to! A posting that “ABC company, a data management firm, has been hacked and they are sending out notices with claim IDs to file a claim to the address they have on record from who knows when and where…just doesn’t seem fair. Again. USPS mail forwarding is 6 months or up to a year if you request an extension. How many victims are not getting the notices and claim ID’s? And now theyve started a registration process that after completed they email you a claim ID to open the claim form. They do not allow the same email twice which isn’t fair to the elderly and disabled that have family or advocates filing claims on their behalf. My elderly parents live with me and I have filed claims on their behalf and gotten denial that duplicate claim cause the address, email, or phone is already on record. they consent to my filing on their behalf. Any correspondence or notifications regarding their claim need to come to me as they are not computer literate nor does the FTC recommend elderly answering unknown numbers. I understand these measures are to prevent fraudulent claims but many victims are being denied without just cause and no notice being sent of denial or chance to correct, provide qualifying documents, or explain what may appear to be duplicate claims, and if there are duplicate claims, that should be no reason for complete dismissal or denial, or assumption of fraud because accidentally filed claim twice, especially if no claim confirmation notice was sent.

Thank you for your time in reading my frustrations with the handling of claims by the settlement administration firms.

I would like to close by saying I think TCA does a great job in keeping consumers informed and advocating for consumer rights, which is the purpose of this communication. The class actions are posted as a method to reach class members, and when a claim is filed..the claimant deserves the respect and acknowledgement by written communication of status of their individual claim and settlement process. (if final hearing was successful and expected payment release dates, if a claim is denied and not only a reason or request, but a chance to appeal denial with written testimony or explanation of extenuating circumstances or error in defining ambiguous data request, and again, notice of an appeal or court ruling that will significantly delay or dismiss the lawsuit entirely)

Again, I thank you for your time and advocacy. I am thankful for the work TCA does and hope my opinions above can be used to further represent class members and claimants.

God Bless You

I also was eligible to claim from Equifax breach but didn’t know anything about it until mid of this year and the time to make a claim has come and passed but I was able to make an extended claim that I haven’t heard anything back about the email they send you says they will respond asap but it’s never asap or at all

Seems like class action is a common thing. I’m just trying to find out how to collect from Wells Fargo for illegally foreclosing on my home. I was originally told there was nothing I could do about it and then ran across an article on a closed class action suit. Looks as if there are several other suits against them as well but I just keep striking out.

Try to get a hold of the class action law suit and code for that law suit.

Create your own class action law suit with those who were affected during the same time frame you were in.

Best of luck to you all!

Not right

Please add me

Please add me

Please sign me up