Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

If you have receipts that contain too much of your credit or debit card information, you may be entitled to money damages of up to $1,000 dollars!

As Americans are stuck at home looking for ways to pass the time, it’s a good opportunity to get all that financial paperwork organized. If you’re someone who saves receipts, it’s always important to check the printed receipts you receive from retailers, restaurants, and service providers —not just to make sure that you were charged correctly, but also to check if your credit or debit card information was printed illegally.

If too much of your credit or debit card information was printed on a receipt, this puts you at risk for identity theft, in addition to several types of credit and debit card fraud. As a result of that risk, you may be eligible for compensation under the Fair and Accurate Credit Transactions Act (“FACTA”). FACTA was passed in 2003 as a way of protecting consumers from identity theft and other related harms, and has been in full effect for businesses since Dec. 1, 2006.

Importantly, if a business prints too much of your credit or debit card information on your receipt, they can be held liable for up to $1,000 per violation and you may be able to file a FACTA lawsuit and pursue compensation on behalf of a Class of people who also received non-compliant receipts.

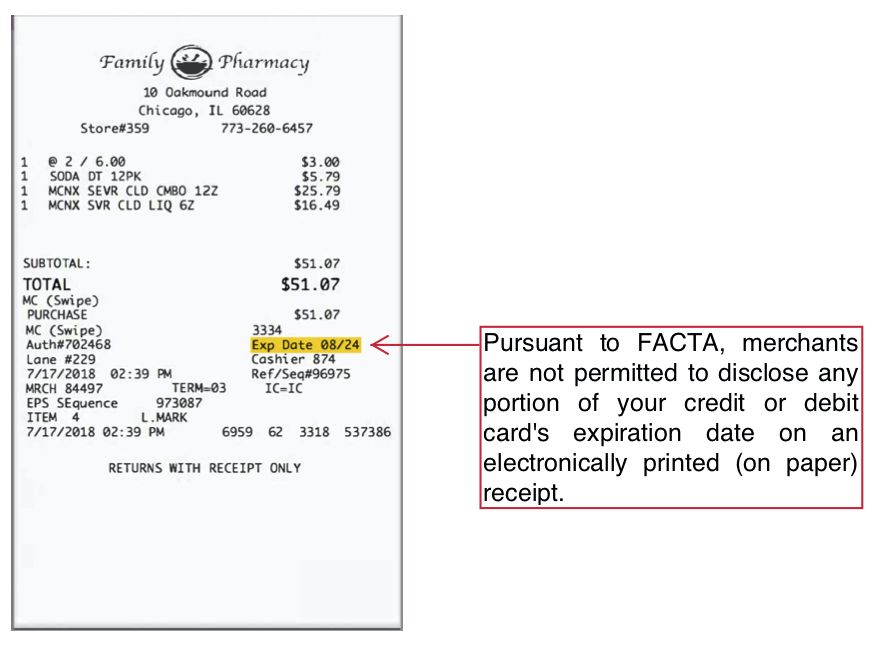

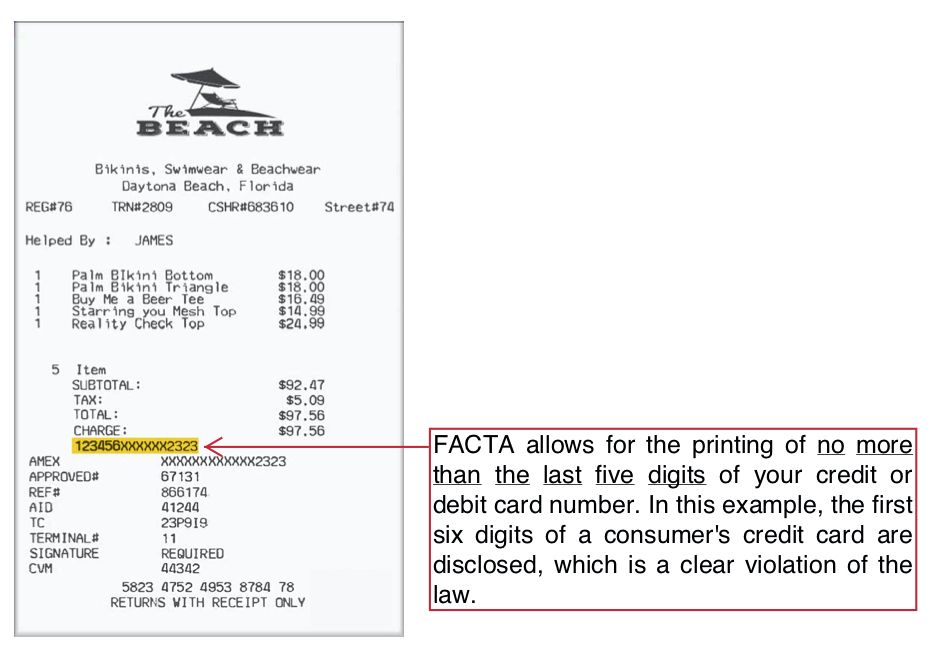

Please note that these FACTA rules only apply to debit and credit card receipts printed from a point-of-sale terminal and do not apply to email, text message, handwritten or imprinted receipts.

The record-breaking $30.9 million Subway settlement!

In 2017, the restaurant chain Subway agreed to pay $30.9 million to settle a class action lawsuit that accused the company of violating FACTA by printing credit card expiration dates on its receipts. The lead plaintiff alleged in his class action lawsuit that Subway violated FACTA when it printed the entire expiration date of customers’ credit and debit cards on receipts.

Under the terms of the settlement, millions of Subway customers who received receipts that showed the expiration dates of their credit or debit cards received a share of the $30.9 million less administrative expenses, attorneys’ fees and the Class representative incentive award. The plaintiff who discovered the receipt and filed the lawsuit received an incentive award of $20,000. An additional $10,000 was awarded to another class representative.

The Subway FACTA class action settlement is now closed. All settlement funds have been distributed, and no new claims are being accepted.

What to do if you find a paper receipt that shows your card’s expiration date or more than the last five digits of your account?

Fill out the form on our FACTA investigation page! Your information will be personally reviewed by Attorney Scott D. Owens – one of the lead attorneys from the aforementioned $30.9 million Subway settlement. In addition to the Subway matter, Mr. Owens has settled FACTA claims against some of the largest companies in the world, including the following:

- LabCorp – $11 million

- Spirit Airlines – $7.5 million

- Godiva Chocolatier – $6.3 million

- Jimmy Choo – $2.5 million

Please note that the statute of limitations (i.e., the time you have to file a lawsuit) in most cases is only two (2) years from the date you received the violative receipt. So don’t delay!

Join a Free Credit Card Receipt Class Action Lawsuit Investigation

If you have a receipt, invoice or contract from a retailer or vendor that includes more than the last five digits of your credit card or debit card number or any portion of the expiration date, you may qualify to file a credit card receipt class action lawsuit.

This article is not legal advice. It is presented

for informational purposes only.

ATTORNEY ADVERTISING

Top Class Actions is a Proud Member of the American Bar Association

LEGAL INFORMATION IS NOT LEGAL ADVICE

Top Class Actions Legal Statement

©2008 – 2024 Top Class Actions® LLC

Various Trademarks held by their respective owners

This website is not intended for viewing or usage by European Union citizens.

45 thoughts onAre You a Receipt Hoarder? You May Be Sitting on the Next $30M Class Action Settlement!

Please add me

REMEMBER “RECEIPTS MUST BE 2 YEARS BACK” AS STATED VERY CLEARLY IN DESCRIPTION & STOP PUTTING “ADD ME TO LIST” IN COMMENT AREA. PLEASE FOLKS START READING FOR ONCE IN YOUR LIFE!

Add me please

Nowhere does it say to say “add me”. You people probably just following the one in front and don’t even know why you are here!

Please add me to your list please

ADD ME PLEASE

Add Me

Folks have a bit of a good old common sense, will ya. Requests to add you in these comments will get you precisely nowhere. Waste of time

Add me please.

Add Me

Add me add me add me add me add me add me please!!!

add me

LOL Just read Bridgette’s comment I’ll follow the links and hope I didn’t throw out the receipts … ugh we’re moving so unfortunately I’ve been purging.