Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

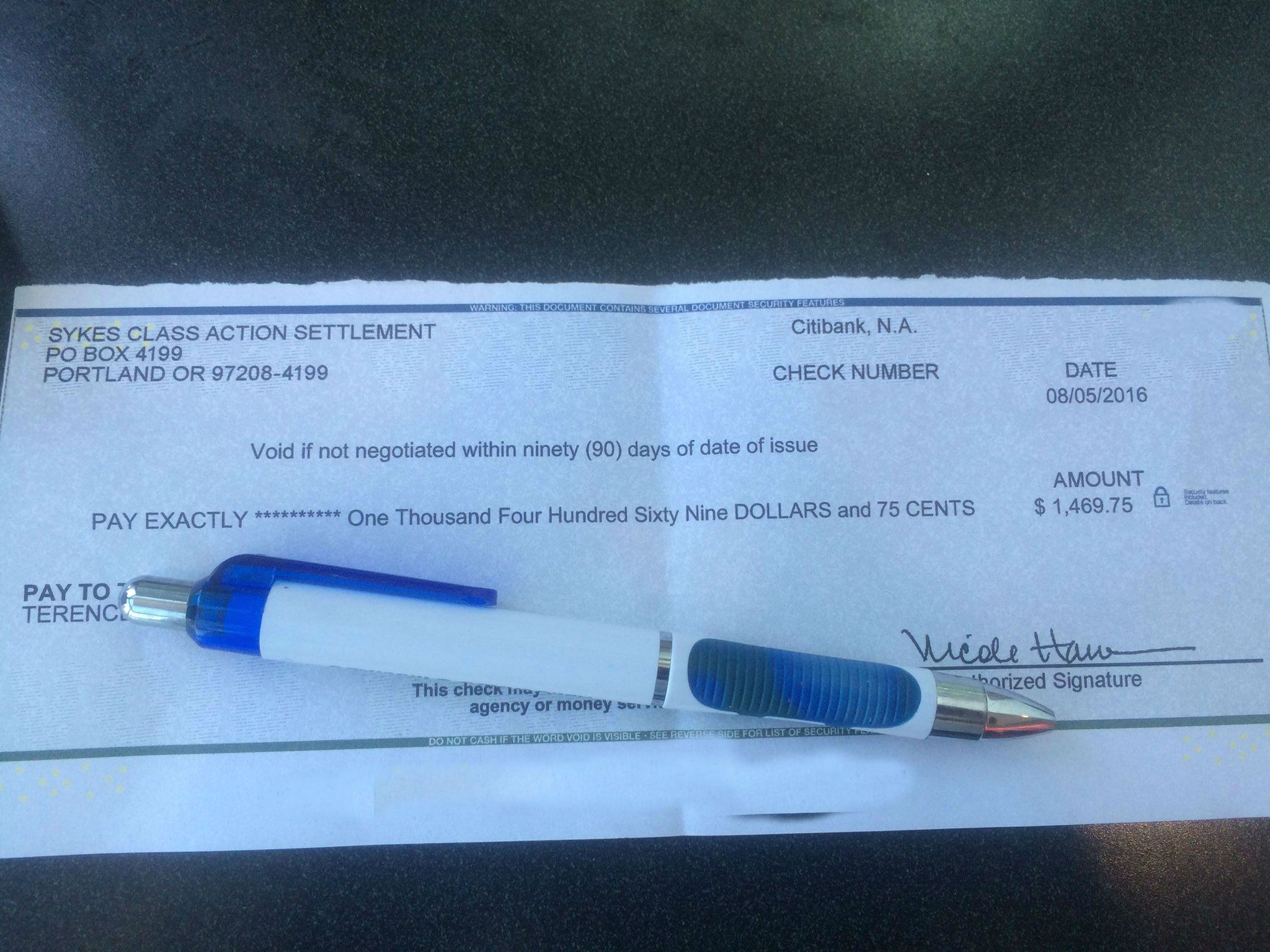

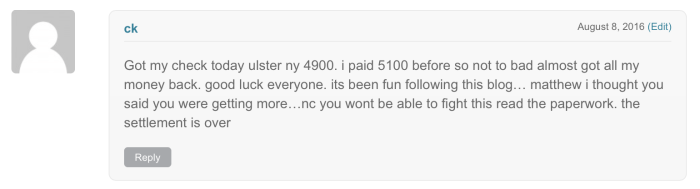

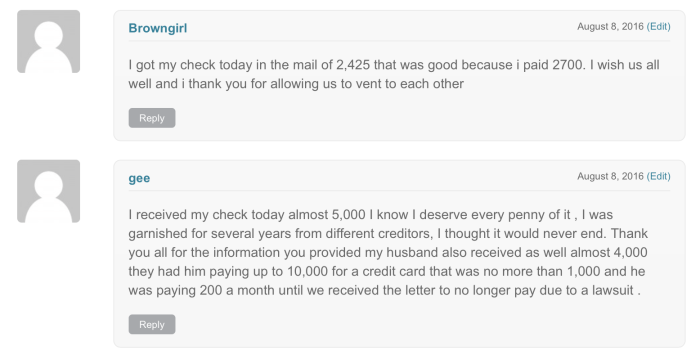

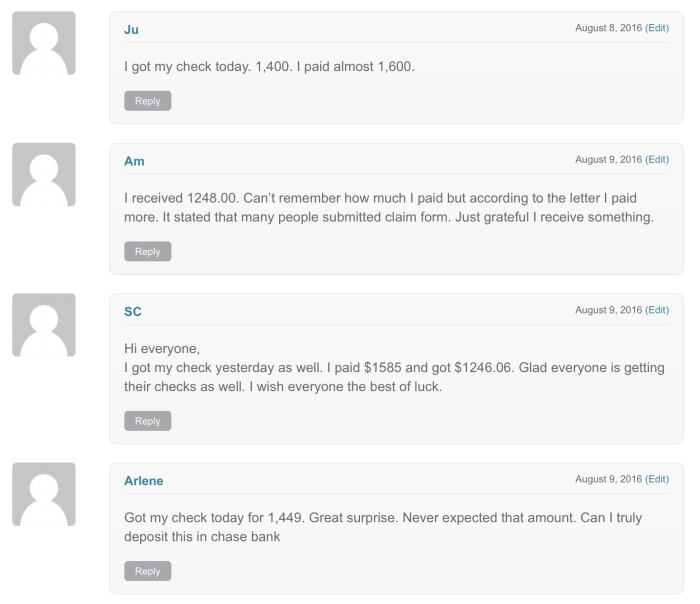

According to comments and posts on the Top Class Actions Facebook page,Class Members who submitted timely and valid claims for the Sykes FDCPA settlement began receiving checks worth as much as $4,900 on Aug. 8, 2016.

If you filed a claim for the Sykes debt collection action settlement, keep an eye on your mailbox because checks are on their way!

The N.Y. debt collection agencies class action settlement resolves allegations that Mel S. Harris & Associates, Leucadia National Corp., and Samserv, Inc. violated the Fair Debt Collection Practices Act (FDCPA) as well as the Racketeer Influenced and Corrupt Organizations Act (RICO), along with New York state laws.

Plaintiff Monique Sykes claimed that Samserv routinely failed to serve summons seeking payments on debts that Mel S. Harris & Associates and Leucadia purchased, even though they allegedly still submitted proof of service to the court.

Sykes further stated that when a debtor failed to appear in court because they weren’t presented with a notice, Leucadia and Mel Harris would apply for default judgement regarding the debt owed.

The defendants denied the allegations but agreed to pay a total of $54.5 million to settle the class action lawsuit.

The debt collection class action lawsuit was open to two Settlement Classes:

- Injunctive Settlement Class Members – included all individuals who were or could have been sued in any New York court by Mel S. Harris & Associates, LLC (or by any other counsel as directed by Mel S. Harris & Associates, LLC), as counsel for LR Credit. Every Class Member whose alleged debt is or was owned by LR Credit is part of the Settlement Injunctive Class, no matter whether he or she ever made a payment to LR Credit (or any of its subsidiaries).

- Money Settlement Class Members included every person sued in any New York court by Mel S. Harris & Associates, LLC, as counsel for LR Credit (or by any other counsel as directed by Mel S. Harris & Associates, LLC), and against whom a default judgment was obtained.

The deadline to file a claim for the N.Y. debt collection class action settlement passed on Apr. 7, 2016.

Congratulations to our Top Class Actions readers who submitted a valid claim and got PAID! If you missed out, sign up for our free newsletter to receive updates on new class action lawsuits and settlements. You can also check out which class action settlements are still accepting claims in our Open Class Action Settlements section.

The plaintiffs are represented by Matthew D. Brinckerhoff, Jonathan S. Abady, Vasudha Talla and Debra L. Greenberger of Emery Celli Brinckerhoff & Abady LLP; Josh Zinner, Susan Shin and Claudia Wilner of New Economy Project; and Carolyn E. Coffey, Ariana Lindermayer and Jeanette Zelhof of MFY Legal Services Inc.

The N.Y. Debt Collection Agencies FDCPA Class Action Lawsuit is Monique Sykes, et al. v. Mel S. Harris and Associates LLC, et al., Case No. 1:09-cv-08486-DC, in the U.S. District Court for the Southern District of New York.

ATTORNEY ADVERTISING

Top Class Actions is a Proud Member of the American Bar Association

LEGAL INFORMATION IS NOT LEGAL ADVICE

Top Class Actions Legal Statement

©2008 – 2024 Top Class Actions® LLC

Various Trademarks held by their respective owners

This website is not intended for viewing or usage by European Union citizens.