Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

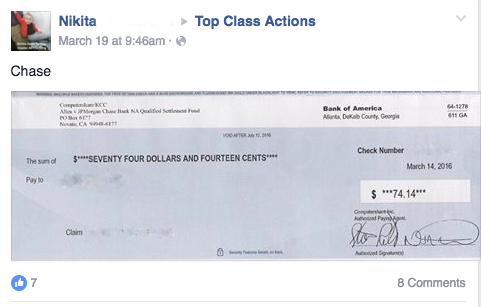

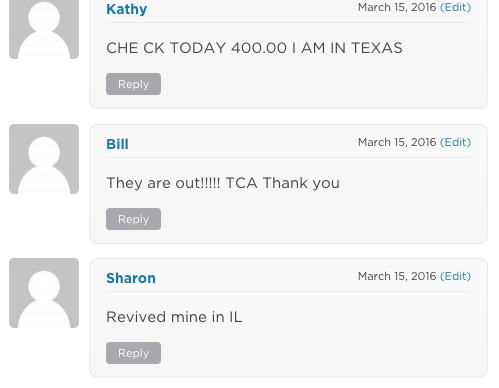

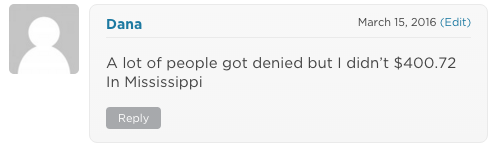

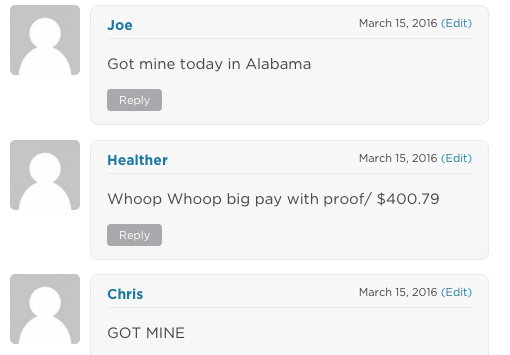

According to reader comments and posts on the Top Class Actions Facebook page, Class Members who submitted timely and valid claims for the JPMorgan class action settlement began receiving checks worth as much as $400.79 on Mar. 15, 2016.

While multiple viewers reported receiving checks for $400, well above the estimated payout, we haven’t been able to confirm that amount. We can confirm that at least one viewer received a payment for $74 (see image below).

If you filed a claim for the JPMorgan Chase TCPA class action settlement, keep checking your mailbox because you may soon be receiving your payment!

The JPMorgan settlement resolves allegations that the financial institution violated the TCPA by placing robocalls to cell phones without prior express consent between Nov. 18, 2009 and May 19, 2015.

According to the JPMorgan class action settlement website, checks were sent out to Class Members on Mar. 13, 2016.

The initial settlement agreement estimated that Class Members would receive between $45 and $55, stating that the actual amount would depend on the total number of valid claims submitted. Since there weren’t as many Class Members as JPMorgan Chase anticipated, those who filed Claim Forms got a much larger payout than originally estimated.

JP Morgan Chase denied all claims of wrongdoing but agreed to the terms of the settlement in order to avoid the expense and risk of further litigation.

The deadline to submit a Claim Form for the JPMorgan Chase class action settlement passed on Sept. 4, 2015.

Congratulations to our Top Class Actions readers who submitted a valid claim and got PAID! If you missed out, sign up for our free newsletter to receive updates on new class action lawsuits and settlements. You can also check out which class action settlements are still accepting claims in our Open Class Action Settlements section.

The plaintiffs are represented by Keith J. Keogh of Keogh Law LTD and Alejandro Caffarelli of Caffarelli & Associates LTD.

The JPMorgan Chase TCPA Class Action Lawsuit Settlement is Sheila Allen v. JPMorgan Chase Bank N.A., Case No. 13-cv-8285, in the U.S. District Court for the Northern District of Illinois.

ATTORNEY ADVERTISING

Top Class Actions is a Proud Member of the American Bar Association

LEGAL INFORMATION IS NOT LEGAL ADVICE

Top Class Actions Legal Statement

©2008 – 2024 Top Class Actions® LLC

Various Trademarks held by their respective owners

This website is not intended for viewing or usage by European Union citizens.

16 thoughts onJPMorgan Chase TCPA Class Action Settlement Checks Mailed

I got a check for 1050.00. And now I’m in trouble with law. They are saying its a fake check

December 20, 2016 have not received any check from chase

New Jersey