Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

Update:

- Lemonade Insurance Co. has reached a $4 million deal to settle claims it collected, stored, analyzed and used the biometric data of thousands of its customers without authorization or consent.

- The plaintiffs, who are policyholders with the insurance technology company, filed a motion for approval of the settlement May 16 in an Illinois court.

- About $3 million of the settlement would benefit about 5,000 Lemonade policyholders in Illinois whose facial data the company allegedly collected between June 2019 and May 2021 without first obtaining written consent or making mandatory disclosures.

- The other $1 million would go to a subclass of about 110,000 policyholders in states other than Illinois, the court filing said.

Lemonade Insurance Co. class action lawsuit overview:

- Who: Plaintiff Mark Pruden filed a class action lawsuit against Lemonade Insurance Co..

- Why: Lemonade Insurance Co. allegedly collected customers’ faceprints without their permission as a part of a fraud-detection program.

- Where: The class action lawsuit was lodged in New York federal court.

(Aug. 24, 2021)

Lemonade Insurance Co. collected, stored, analyzed and used the biometric data of thousands of its customers without authorization or consent, a new class action lawsuit alleges.

Lead plaintiff Mark Pruden claims Lemonade Insurance Co. lied to and misled its customers when it assured them it would not collect, require, sell or share their biometric data. Pruden wants to represent a nationwide Class of consumers.

Lemonade Insurance Co. collects faceprints to detect fraud

Biometric data consists of an individual’s unique personal characteristics such as their retinas, fingerprints, voiceprints, and hand and face geometry.

Customers became aware in May that Lemonade Insurance Co. was collecting their biometric data, after the company posted a series of since-deleted tweets explaining how it uses facial recognition technology for fraud detection purposes, the class action lawsuit alleges.

Facial recognition technology is widely used to scan images of human faces in order to generate a “faceprint”. Lemonade Insurance Co. assures its customers in its Data Privacy Pledge it will not collect, require, sell, or share users’ biometric data, points out the class action lawsuit.

“The unsuspecting consumers, including Plaintiff and the Class members, fell for these promises in relying on Lemonade’s guarantees to their detriment,” states the class action.

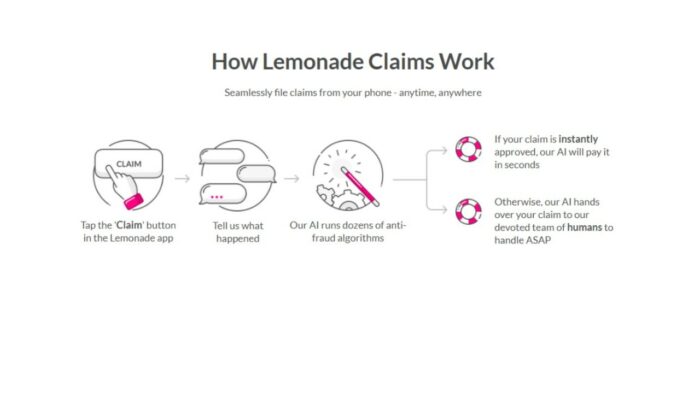

Pruden claims Lemonade Insurance Company tricks its customers into providing biometric data by requiring them to upload a video explaining the circumstances behind their insurance claims. The company then benefits financially from the biometric data it gathers, according to the class action lawsuit.

This puts Lemonade Insurance Company in violation of New York State’s statutory and common law, including New York’s Uniform Deceptive Trade Practices Act, claims the class action lawsuit.

“Lemonade derives sizeable commercial and financial benefit from its undisclosed practice of collecting customers’ biometric data,” the class action lawsuit states.

Pruden claims had they and other class members known about Lemonade Insurance Co.’s biometric data collection practices they would have either not purchased or paid less to be insured by the company.

Plaintiff is demanding a jury trial where they are seeking to be awarded compensatory, statutory, nominal, consequential and restitution relief for themselves and the proposed class.

Biometric privacy was in the news earlier this month after three U.S. senators sent a letter to Amazon asking for more information regarding the company’s Amazon One palm print payment system.

Topgolf, meanwhile, agreed to a $2.6 million settlement in early August after a class action lawsuit was filed against the company for having its Illinois employees clock in and out of work using a finger scanner without first signing a biometric consent form.

Would you feel comfortable having Lemonade Insurance Co. store your biometric data? Let us know in the comments.

The plaintiff is represented by Christian Levis, Andrea Farah and Amanda Fiorilla of Lowey Dannenberg PC.

The Lemonade Insurance Co. class action lawsuits are Pruden v. Lemonade Inc., et al, Case No. 1:21-cv-07070, in the U.S. District Court for the Southern District of New York, and Alexander Clarke, et al. v. Lemonade Inc., et al., Case No. 2022LA000308, in the Circuit Court of DuPage County, Illinois.

Don’t Miss Out!

Check out our list of Class Action Lawsuits and Class Action Settlements you may qualify to join!

Read About More Class Action Lawsuits & Class Action Settlements:

- Walgreens Kept Doctor’s Prescription Data From Store Pharmacists, Manager Testifies in Opioid Bellwether

- Filters Fast Data Breach Class Action Settlement

- Noom Autorenewal and Cancellation Policy $56M Class Action Settlement

- Liberty Mutual, Safeco Total Loss Claims Class Action Lawsuit Investigation (Missouri Residents Only)

28 thoughts onLemonade Settles BIPA Faceprint Data Class Action For $4M

Please add me

Yes add me

Please add me. I’m currently waited ng for a claim of $30,000. I’m going to be homeless. Our uhual got stolen with my way to make money and all our assets. They claim that the proof of loss doesn’t apply. Now I’ve used every penny I had waiting on this claim and I’m going to be on the streets if I don’t get all or so me of that money. They don’t care they have given me every excuse in the book. And the claims adjuster is always on vacation. Must be nice.