Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

This settlement is closed!

Please see what other class action settlements you might qualify to claim cash from in our Open Settlements directory!

We’re sorry! This settlement is CLOSED!

No more submissions are allowed.

Please join the Top Class Actions Newsletter

list so you don’t miss out next time and head

over to the OPEN SETTLEMENTS section

to see what’s available!

Click here to skip the legal notice and go straight to the Top Class Actions article on this class action lawsuit settlement.

Award (how much your claim may be worth):

Average payout appears to be ~$50. Check the comments below and leave one if you received your check.

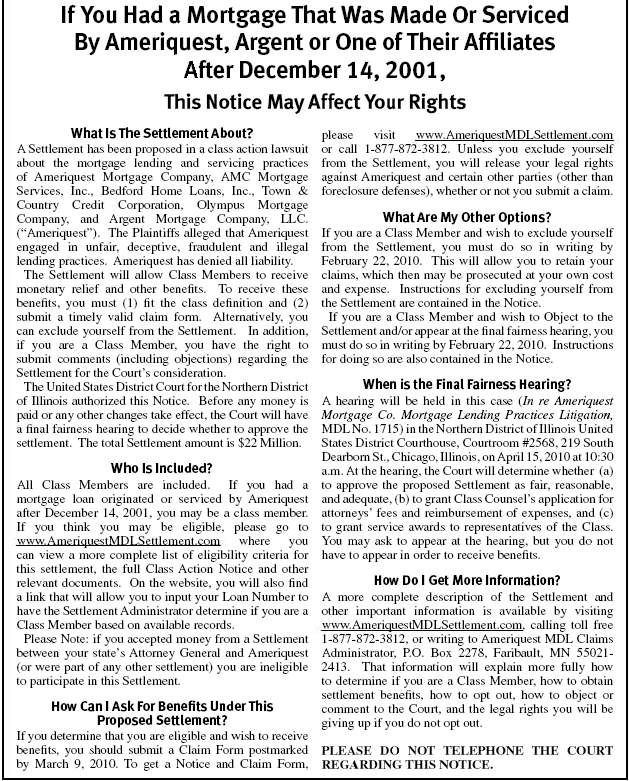

Class Action Lawsuit Settlement Case(s): v. Ameriquest Mortgage Company et al. IN THE UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF ILLINOIS MDL No. 1715, Lead Case No. 05-cv-07097

Company(ies): Ameriquest Mortgage Company

AMC Mortgage Services, Inc. (FKA Bedford Home Loans, Inc); Town & Country Credit Corporation; Olympus Mortgage Company (NKA Bedford Home Loans, Inc.); and Argent Mortgage Company, LLC

Website Link to access the Class Action Lawsuit Settlement and get YOUR Stake (SUBMIT YOUR CLAIM HERE): Settlement Administrator Website

Address of Class Action Lawsuit Settlement Administrator to submit a claim form (NOT REQUIRED):

Ameriquest MDL Settlement Administrator

P.O. Box 2278

Faribault, MN 55021-2413

or FAX your claim form to 1-866-590-8535

Phone Number to call for assistance: 1-877-872-3812

Details: The Ameriquest mortgage class action lawsuit settlement includes all who originated their mortgage through Ameriquest or one of the other companies listed above. It’s important to note that even though your mortgage may not be currently services by Ameriquest, if it originated through them you may be eligible to submit a claim. In addition, the Ameriquest mortgage class action lawsuit settlement combines more than a dozen individual cases into one large settlement. If your mortgage loan with Ameriquest originated after December 14th, 2001 you’re likely included in the Ameriquest mortgage class action lawsuit settlement. The five classes included in this settlement are:

CLASS ONE: TILA RESCISSION CLASS

The TILA Rescission Class is a nationwide class of borrowers who at any time on or after February 8, 2003, (or, for residents of Massachusetts, at any time on or after February 8, 2002) have actually requested rescission in writing of their loans pursuant to applicable provisions of the Truth in Lending Act or state disclosure laws on or before December 1, 2009.

CLASS TWO: BAIT AND SWITCH CLASS

The Bait and Switch Class is a nationwide class of borrowers who meet one or more of the following criteria:

(i) loan records establish a final disclosed annual percentage rate that is at least 0.9% higher (as calculated pursuant to TILA) than the disclosed annual percentage rate (calculated pursuant to TILA) contained in preclosing written disclosures made to the borrower;

(ii) loan records establish that the borrower received a loan containing a prepayment penalty, but preclosing written disclosures made to the borrower described a loan without a prepayment penalty; or

(iii) loan records establish that the borrower received a loan containing a variable rate, but preclosing written disclosures made to the borrower described a loan containing a fixed rate.

CLASS THREE: DISCOUNT POINTS CLASS

The Discount Points Class is a nationwide class of borrowers who either entered into loans (i) made after December 14, 2001, and before February 3, 2003, on which they had to pay discount points in any amount; or (ii) made on or after February 3, 2003 on which they had to pay at least three discount points.

CLASS FOUR: WHOLESALE BORROWER CLASS

The Wholesale Borrower Class is a nationwide class of borrowers who paid an amount constituting more than 3% of their funded loan amount in settlement charges to Ameriquest or a mortgage broker.

CLASS FIVE: LOAN SERVICING CLASS

The Loan Servicing Class is a nationwide class of borrowers who paid Ameriquest default and delinquency fees or costs in an amount in excess of a total of $1,000. These fees and costs include fees listed in Ameriquest’s records as late fees, legal fees, phone pay non sufficient fund (NSF) fees, bad check non sufficient fund (NSF) fees, appraisal fees, inspection fees, and recoverable corporate advance fees.

Most people whose mortgage was originated by Ameriquest after December 14th, 2001 will fit into one of the classes above. If you received a notice from Ameriquest make sure to take the time and submit your claim in the Ameriquest mortgage class action lawsuit settlement. The class you fit in above will determine how much you will get paid in the Ameriquest mortgage class action lawsuit settlement. This could pay you thousands of dollars. DON’T MISS OUT ON IT! Submit your claim in the Ameriquest mortgage class action lawsuit settlement now.

Purchased From: After December 14th, 2001

Claims Accepted Until (YOU MUST SUBMIT YOUR CLAIM BY THIS DATE!): 3/09/10

{loadposition content_inline}

Class Action Lawsuit Settlement Amount(s): $22,000,000 = $200,000 in Foreclosure Prevention Counseling + $14,345,000 to Consumers (ESTIMATE) + $7,330,000 Attorney Fees and Expenses + $7,500 to each Lead Plaintiff

Settlement Administrator(s): Rust Consulting, Inc.

Plaintiff Counsel:

Defense Counsel:

Bernard E. LeSage

Sarah K. Andrus

Adam Bass

BUCHALTER NEMER

Thomas Wiegand

WINSTON & STRAWN, LLP

TCA Staff Tidbit:

This site provides information about the law and class action lawsuit settlements designed to help users safely cope with their own legal needs. Legal information is NOT the same as legal advice – the application of law to an individual’s specific circumstances. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a lawyer if you want professional assurance that our information, and your interpretation of it, is appropriate to your particular situation. You should consider all postings or writings at TopClassActions.com by staff or others as personal opinion only and NOT the advice of a lawyer. Top Class Actions Legal Statement

119 thoughts onAmeriquest Mortgage Class Action Lawsuit Settlement

because the company was in California and no one knew as of yet what was really going on. After losing all this equity, including being treated criminally.. unfair business practices etc.. I noticed when I wasn’t home things started disappearing from my house.. I called police and filed reports, I thought they were possibly local burglary cases. Then, my dad caught them in my driveway with a truckload of things, and when he asked them who they were, they claimed they were hired by Ameriquest but wouldn’t give their names. They took off without my dad being able to catch them or get a

tag number. After calling the mortgage company and complaining. and speaking to a girl named Jennifer and her supervisor.. they admitted that it was someone in the retention department that wasn’t authorized to verbally carry this out and admitted that it was criminal.

I had contacted the insurance commissioner and the Attorney General in my state about their illegal practices. They promised me relief and payments to be back to what we had agreed on. But when the 6months were up they never let me go back to regular payments and made me do a re-modification and this mean’t 2 payments up front and 6 mths of paying in theremod plan.But on the day I faxed it in they claimed that it was just a few minutes too late and so they were going to

foreclose. I HAD PROOF IT WAS FAXED ON TIME! I didn’t know at the time but this is when everybody around the globe was having the same problems. The next thing I know, after not being able to get a lawyer in my area to represent me.

I asked to have my equity and they assured me. I mean, all I was doing was transferring the loan out of my husbands name. I never looked, just thinking I had my equity.. then when I did I realized I owed over 95,000 to the company with no equity. They also informed me that my payment would be going up

200.00 dollars the next year. So I tried to hurry and re-finance, but the loan was so new, no one would touch it. They tried foreclosing on me when I couldn’t pay the higher payments.. but I got it reversed and started a loan modification. where I paid 2 payments up front then paid 6 mthly installments and then was supposed to go back on my regular payments.

I had Washington Mutual for 10 years on my home loan. Bought my house for 89,500 (a steal) 2500 sq.ft, 4 br 2 b home. paid it down to 62,000 in 10 years. So i divorced and tried getting the loan in just my name but Washington Mutual no longer serviced my area.. HENCE. I found Ameriquest online. Big mistake! at the time, I wasn’t working ( injured on the job Physical Therapist ) tHey were jumping at my feet to get my loan, which at the time, I thought was odd.. since I had no job and such an injury where there was no prospect of me returning to work anytime soon, It was so easy to get this loan.. and after I signed, they immediately told me they had made a mistake on my interest rate and it went up 3 points and I wasn’t told until I had already signed the papers.

I did get a penny I wrrote more then 10 letters and never recieved a response so here the attorney got all the money and their staff they benefit from our pain

Ameriquest Mortgage Class Action Lawsuit Settlement

Yes my wife & I received are check for the total sum of $52.10, we live in Ohio. After talking to a friend that’s in the Mortgage business we found out that Argent Mortgage stole over $6,000.00 of our own money when we refinanced are home and cashed out on some equity. Feeling just a bit more then just slighted at this point. However, on a better note don’t go cashing those Big checks right away, if you do I found out that you lose any and all rights when the checks are cashed, that meaning that you accept that amount as payment of the settlement.

Ameriquest Mortgage Class Action Lawsuit Settlement

I think ameriquest is connected to American Express. I am in Detroit and I so needed this money. God is going to get someone about this – it is so unfair. My son-in-law could not believe what he read in our ameriquest mortgage. How can they get away with this. I smell something that really stinks. Does anyone have a conscience anymore? What can we do?

LORD HELP!!!

Ameriquest Mortgage Class Action Lawsuit Settlement

The sad part is I was working with one of the Attornies on this case. I had been with them since 2005, I supplied them with all the information about my loans. So please tell me where in the hell are these lead plaintiffs at? I want to see the attornies they were working with and their names. Because I think we got taken by the attornies also. I sure as hell didn’t get no 7,500 dollars for providing my information, staying in contact with the attorney. There is something fishy going on here!… So yes we need to do something. Nothing like being ripped off by the attornies and the courts also.

Ameriquest Mortgage Class Action Lawsuit Settlement

I had two loans. I got a check for the first one. $48.34 cents. I called on the second one and they refused to tell me the amount. Said that since I filed over the internet, the check was sent to the property address ( which I have not owned for over 6 years.) We lost over 80,000 in so called fees we had to pay. Ameriquest refused to cash our house payments. Finally had to hire attorney to save the second house. So… big difference you loose $80,000 and get a check for 48.34… and then those idiots still changed my information i filed with ( the correct address ) and sent the other payment to the old property.. they said oh well. We need to go after them, they are crooks.

Ameriquest Mortgage Class Action Lawsuit Settlement

:'(. You have GOT to be kidding me! $48!! I get ripped off for $8,000 + and I get $48!!??!?!? And I thought getting only getting $1,000 still wasn’t even fair!!!!! WTF?!