Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

Mark Cuban Voyager Digital class action lawsuit overview:

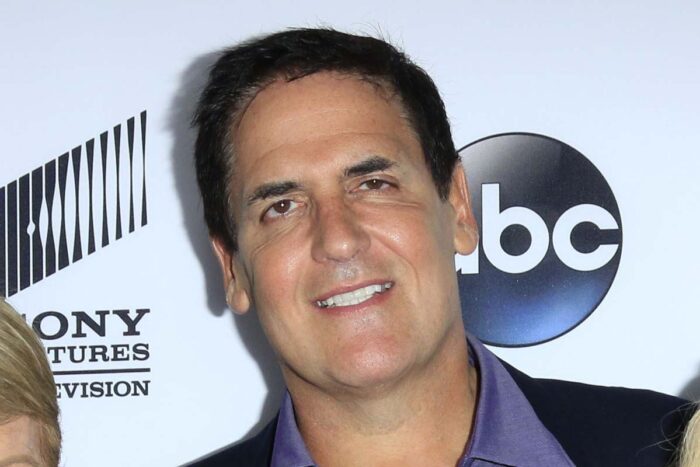

- Who: A group of Voyager Digital investors have filed a class action lawsuit against Mark Cuban, the Dallas Mavericks and Voyager CEO Stephen Ehrlich.

- Why: Investors claim Cuban, the Mavericks and Ehrlich misled them into investing in the Voyager platform, which they argue was a Ponzi scheme that cost 3.5 million Americans more than $5 billion.

- Where: The class action lawsuit was filed in Florida federal court.

Dallas Mavericks owner and “Shark Tank” entrepreneur Mark Cuban and Voyager Digital CEO Stephen Ehrlich “duped” millions of Americans into investing into the “deceptive” Voyager platform, a new class action lawsuit alleges.

A group of Voyager investors argue the platform was a Ponzi scheme and an “unregulated and unsustainable fraud” which cost more than 3.5 million Americans investors more than $5 billion in losses.

“The Deceptive Voyager Platform is based upon false pretenses, false representations, and is specifically designed to take advantage of investors that utilize mobile apps to make their investments, in an unfair, unsavory, and deceptive manner,” the Mark Cuban lawsuit states.

Cuban and Ehrlich, investors claim, “personally reached out” to them — including through the Dallas Mavericks NBA franchise — to “induce them to invest” in Voyager’s alleged unregistered securities.

Investors argue Cuban, Ehrlich and the Dallas Mavericks are ultimately responsible for their financial losses and are “responsible for paying them back.”

Investors want to represent a nationwide class and multistate subclass of investors who purchased Voyager securities or enrolled in its Voyager Earn Program Accounts.

Voyager filed for Chapter 11 protection amidst millions in losses

Voyager filed for Chapter 11 bankruptcy protection after it became known that it had allegedly lost hundreds of millions of dollars worth of investors’ cryptocurrency assets, the Mark Cuban lawsuit states.

Investors argue that, before Voyager filed for bankruptcy, Ehrlich and Cuban continued to mislead the public in order to keep money flowing into the business.

Cuban, for his part, called the Voyager platform “as close to risk free as you’re gonna get in the crypto universe” and talked about his own investment into the company, according to the Mark Cuban class action.

Investors’ claims include unjust enrichment, aiding and abetting fraud, and civil conspiracy, among other things, as well as violations of multiple acts and codes, including the Alabama Deceptive Trade Practices Act.

Plaintiffs are demanding a jury trial and requesting injunctive and declaratory relief along with statutory and multiple damages for themselves and all class members.

A similar class action lawsuit was filed against Coinbase in March over claims the company operates as an unauthorized securities exchange.

Were you financially injured after investing in the Voyager Digital platform? Let us know in the comments!

The plaintiffs are represented by Adam M. Moskowitz, Joseph M. Kaye and Barbara C. Lewis of the Moskowitz Law Firm PLLC.

The Mark Cuban Voyager Digital class action lawsuit is Robertson, et al. v. Cuban, et al., Case No. 1:22-cv-22538, in the U.S. District Court for the Southern District of Florida.

Don’t Miss Out!

Check out our list of Class Action Lawsuits and Class Action Settlements you may qualify to join!

Read About More Class Action Lawsuits & Class Action Settlements:

- Robinhood lawsuit over ‘meme’ stock restriction escapes dismissal

- Twitch Leak Hacker Posts All Source Code to Anonymous Online Imageboard 4chan

- Investors Say Robinhood Has No Grounds To Dismiss MDL Over ‘Meme Stock’ Class Action

- $100 Million Settlement Reached in Healthcare Co. Novo Nordisk Securities Class Action

8 thoughts onMark Cuban lawsuit alleges ‘Shark Tank’ personality lured consumers into Voyager Digital Ponzi scheme

OMG, please add …

Add me, I watch my account with them daily

They are still holding my investment in Ethereum with no set date of when they will release my crypto to me. Interested in joining lawsuit.

Add me to this lawsuit please.

Add me please

They should have brought that bridge in Brooklyn, they could have sold it as scrap. You don’t get rich quick, you get broke quick.

Yes, this whole thing stinks! I had almost 8K in USDC, and thought it was FDIC insured, these billionaires need to be more careful who they represent & team up with, cause its going to cost him now! Add me, I want my money back, alot of us single moms had money in there & to just lose it all sucks, so many sad stories on Reddit! I’m in Florida!

Add me to this class action sued