Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

This settlement is closed!

Please see what other class action settlements you might qualify to claim cash from in our Open Settlements directory!

We’re sorry! This settlement is CLOSED!

No more submissions are allowed.

Please join the Top Class Actions Newsletter

list so you don’t miss out next time and head

over to the OPEN SETTLEMENTS section

to see what’s available!

Click here to skip the legal notice and go straight to the Top Class Actions article on this class action lawsuit settlement.

Award (how much your claim may be worth):

$20 – $750 (depending on the type of claim you submit and the total number of claims received)

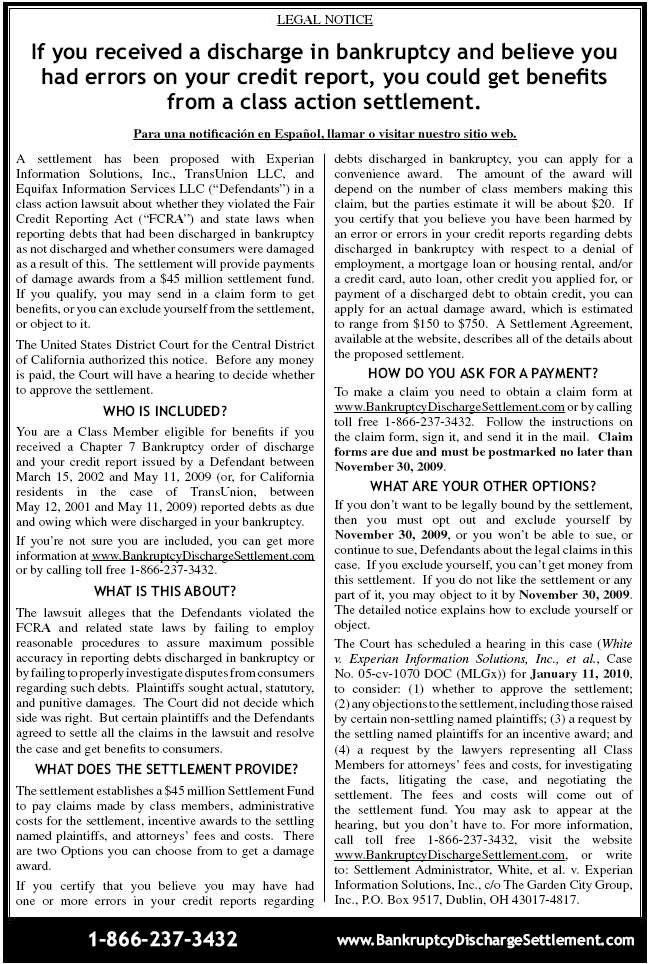

Class Action Lawsuit Settlement Case(s): White, et al. v. TransUnion LLC, Experian Information Solutions, Inc., and Equifax Information Services LLC, et al., Case No. 05-cv-1070 DOC (MLGx), United States District Court for the Central District of California Southern Division

Company(ies): TransUnion LLC

Website Link to access the Class Action Lawsuit Settlement and get YOUR Stake (COMPLETE AND SUBMIT YOUR CLAIM FORM ONLINE HERE): Settlement Administrator Website

Address of Class Action Lawsuit Settlement Administrator to submit a claim form (REQUIRED IF YOU DIDN’T RECEIVE NOTICE IN THE MAIL AND DON’T HAVE A CONTROL NUMBER):

White, et al. v. Experian Information Solutions, Inc.

c/o The Garden City Group, Inc.

P.O. Box 9517

Dublin, OH 43017-4817

Phone Number to call for assistance: 1-866-237-3432

Details: This class action lawsuit settlement covers those who claimed bankruptcy and had errors on their credit reports from TransUnion, Experian and/or Equifax. The errors may have included charges on the credit report which should have been expunged by the bankruptcy. The amount you can claim depends on what happened to you in your specific situation. If you had debts listed on your credit report that should have been listed as discharged by the bankruptcy, but weren’t, and nothing bad happened because of it (you weren’t denied a job, mortgage or credit card) than you can submit a claim for Option 1, which is a convenience award estimated to be $20. This is the “easy” claim and it’s estimated that the majority of claimants will fit into Option 1.

If you suffered damages from the error on your TransUnion, Experian and/or Equifax credit report you can claim significantly more in this class action lawsuit settlement. If you suffered damages you can claim Option 2. Option 2 in the credit reporting error class action lawsuit settlement is estimated to give your $750 (estimated) if you weren’t hired for a job due to your credit report, $500 (estimated) if you were denied a mortgage loan because of the error on your credit report or $150 (estimated) if you were denied a credit card, auto loan or other bank loan because of the error on your credit report. If you choose Option 2 you must list the month and year you were denied the item you are claiming. The settlement administrator will pay you the highest amount you qualify for. Payment will be made only for the highest dollar category for which you qualify even if you qualify for two or three of them. Also, the exact amounts may be somewhat higher or lower than the projected amounts, depending on the number of class members who qualify for awards under this Settlement. For example, if you were denied a home mortgage loan and also weren’t hired for a job because of the error(s) on your credit report you would be paid $750 (estimated) in this class action lawsuit settlement because they are only paying you for ONE incident, not two, and will automatically pay you for the option which grants you a higher dollar amount. If you submit a claim for Option 2, and the settlement administrator determines you don’t qualify for it, they will automatically pay you the Convenience Award of $20. Now, head over to the Settlement Administrator website, print out your claim form, fill it out completely, sign it, date it, and submit it!

Purchased From: March 15, 2002 – May 11, 2009 (or, for California residents in the case of TransUnion, between May 12, 2001 and May 11, 2009)

Claims Accepted Until (YOU MUST SUBMIT YOUR CLAIM BY THIS DATE!): 11/30/09

{loadposition content_inline}

Class Action Lawsuit Settlement Amount(s): $45,000,000 = $10,000,000 to the affected class claiming Option 1 (those claiming the convenience award of $20 each) + $23,430,000 (ESTIMATE) to the affected class claiming Option 2 + $20,000 ($5,000 to each Lead/Named Plaintiff) +$11,250,000 Attorney Fees + $300,000 (ESTIMATE) Settlement Administrator Charges/Expenses

Settlement Administrator(s): The Garden City Group, Inc.

Plaintiff Counsel:

Michael W. Sobol, Esq.

LIEFF CABRASER HEIMANN & BERNSTEIN, LLP

Michael Caddell, Esq.

CADDELL & CHAPMAN

Lee A. Sherman, Esq.

CALLAHAN, MCCUNNE & WILLIS, APLC

National Consumer Law Center

Consumer Litigation Associates

Defense Counsel:

Craig E. Bertschi, Esq.

Cindy Hanson, Esq.

KILPATRICK STOCKTON LLP

Daniel J. McLoon, Esq.

Michael G. Morgan, Esq.

JONES DAY

Julia B. Strickland, Esq.

Stephen J. Newman, Esq.

STROOCK & STROOCK & LAVAN LLP

TCA Staff Tidbit:

This site provides information about the law and class action lawsuit settlements designed to help users safely cope with their own legal needs. Legal information is NOT the same as legal advice – the application of law to an individual’s specific circumstances. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a lawyer if you want professional assurance that our information, and your interpretation of it, is appropriate to your particular situation. You should consider all postings or writings at TopClassActions.com by staff or others as personal opinion only and NOT the advice of a lawyer. Top Class Actions Legal Statement

91 thoughts onBankruptcy Discharge Credit Report Errors Class Action Lawsuit Settlement

These people as to my guess are hoping we forget about htis money, meanwhile they are ca$hing in and laughing all the way to the bank? dont take this call 1-866-237-3432 or write to:

White et al v. Experian Box 9517,

Dublin Ohio 43017-48178

dont let these lawyers off the hook…this would not surprise me if they give us another sob story…it figures, just like the obummer administration, bunch of crooked lawyers…

I have been following the case I just wanted to know when are the money coming I thought I miss out because I move I do have claim number but I move from 340 Oakwood Ave Rockford ill. I live now at 1318 blaisdell St. Rockford Illinois 61101. I just wanted someone to know my knew address so van u respond and let me know you got this. The blessing when it come will come my no.7797700063

i have been followingup as of 2009. my question to all is

45 mil is alot of money. will the remaining amt be devided

to all that participated on the settlement and will we be notified to how much we will be recieving.

p.s to all that is involve with the settlement pls donot

give up hope.

Best bet is to research the church, most NUNS in the church will help you find a way to get this done. Also contact SCORE and there are people who will help you as well. Do this good thing in a home with the right nurses and help. don’t get caughtup with franchises they suck. also contact the State to find out what is needed like insurances, taxes, beds, what is needed in the home for the disable. it alot of work but the tax breaks are great and the money is also.

I loved reading all of your thoughts. I was wondering if someone could help me. I am looking to start a home for elderly couples. It is very hard on my family, with all the long hours. Does anyone know if senior care franchise is a good choice for us? Any thoughts?

What I am reading is that I have gotten screwed by the system once again. It is funny when big companies like the credit breaura report wrong information wrong thousands if not millions of people the outcome is oh well to bad. Yet they screw up your credit for life. I have spent over 7 years and thousands of dollars trying to fix this mess on my credit, and they don’t even have to correct it. What pisses me off is they could wipe out the mistake and/or pay us. But the lawyers got paid so @#$&#! everyone else, what a joke.

WHY DO WE THEHAVE TO WAIT? WHERE ARE THE ATTORNEYS? WHY WILL THE ATTORNEYS NOT PAY THE PEOPLE WHO ARE APPEALING THERE IS ONLY 6 OF THEM? ATTONREY HAVE MADE ENOUGH MONEY OFF THIS CASE, LET THEM PAY THE PEOPLE, RIGHT.. WRITE THE ATTORNEYS, SEND LETTERS TO THE JUDGE THE DEFENDANTS ARE ONLY TRYING TO GET AS MUCH TIME TO [PAY ANYWAY AND USING THE COURT SYSTEM TO DO IT. THE ATTORNEY SHOULD FILE THE PROPER PAPER WORK TO SHOW THIS. AND MAKE A MOTION FOR THIS ACTION. WHERE ARE YOU ATTONRYES WE WANT TO GET PAID AND WHAT YOU GOT US IS NOT ENOUGH ANYWAY. THE ATTORNEYS SHOULD PAY US OUT OF THERE SHARES AND THEY CAN WAIT.

Wow! who in their right minds would file an appeal-the judge has already determined the outcome of the money & in an appeal your going to lose & at best your not going to receive any more money then you would ‘ve gotten prior !!@!##?? so lets get on with it!!!

Yes, We the people were wronged and what is the udge doing?giving the attorneys money for what? what do we get $29.00 yea right. Everyone needs to write the Judge and explain this to him and explain that he must answer to the higher up when his time comes. he should have given the people money in this matter that were really wronged and not the attorneys who took the moey. PEOPLE WRITE THE JUDGE AND LET HIM KNOW WHAT WE ALL THINK OF HIM AND WHY HE KILLED OUR HOPE FOR JUSTICE.

Final order! but what about us,the very one’s that were wronged in this matter! Isn’t the court system supposed to be about justice,well how is this justice when everyone is getting recompensed except for the very one;s that were harmed in this matter!