Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

The July 29 decision by U.S. District Judge James Lawrence King comes nearly a year after U.S. Bank agreed to pay $55 million to settle three class action lawsuits pending in the massive multidistrict litigation (MDL), known as In re: Checking Account Overdraft Litigation, involving more than 30 different banks nationwide.

The class action settlement resolves allegations that U.S. Bank posted debit card transactions to consumer deposit accounts from highest to lowest dollar amount instead of the order in which they were made. Plaintiffs claim that, instead of declining transactions when an account had insufficient funds to cover a purchase, U.S. Bank authorized the transactions and reordered their posting to increase the number of overdraft fees charged to customers.

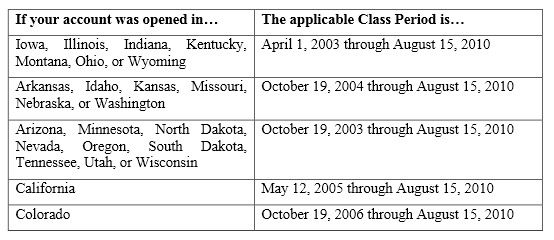

Class Members of the U.S. Bank overdraft settlement include anyone who had a U.S. Bank consumer deposit account that could be accessed with a U.S. Bank debit card during the applicable Class Period and who were charged one or more overdraft fees as a result of the bank’s improper debit posting policy.

The applicable Class Period depends on the state where your U.S. Bank deposit account was opened:

The amount of money you can receive from the U.S. Bank overdraft settlement will depend on the number of overdraft fees you incurred. Only a small percentage of all overdraft fees that were charged by U.S. Bank were affected by high to low posting. So, not every overdraft fee that was charged is eligible for payment under this class action settlement.

Payments will be automatically credited to your U.S. Bank account or (if you no longer have that account) by check mailed to the address U.S. Bank has on file. There is no claim filing process.

More information on your rights in the U.S. Bank Overdraft Class Action Lawsuit Settlement can be found at www.USBankOverdraftSettlement.com. [Editor’s Note: this website was not yet active at time of publication.]

A Final Approval Hearing is scheduled for December 18, 2013.

UPDATE 1/2/14: The Settlement Administrator has posted the following update:

The Final Approval Hearing was held on December 18, 2013. Following the presentations of counsel, the Court announced its intention to grant Final Approval to the Settlement, to award Service Awards to the twelve (12) named Plaintiffs, and to award Class Counsel attorneys’ fees equal to thirty percent (30%) of the Settlement Fund plus reimbursement of certain expenses. The Court has not yet entered a Final Approval Order and Final Judgment. This website will be updated again as soon as the Final Approval Order and Final Judgment are entered by the Court.

The case is In re: Checking Account Overdraft Litigation, Case No. 1:09-md-02036, in the U.S. District Court for the Southern District of Florida.

UPDATE: 2/20/14: The Settlement Administrator has posted the following update:

On January 6, 2014, the Court granted Final Approval to the Settlement, and on January 15, 2014, the Court entered Final Judgment. In the event there are no timely appeals, the Effective Date will be February 24, 2014, and distribution of awards to eligible Settlement Class Members by account credit for current customers or by mailed check for former customers will occur no later than June 24, 2014. This site will continue to be updated as specific dates and details regarding distribution become available.

ATTORNEY ADVERTISING

Top Class Actions is a Proud Member of the American Bar Association

LEGAL INFORMATION IS NOT LEGAL ADVICE

Top Class Actions Legal Statement

©2008 – 2024 Top Class Actions® LLC

Various Trademarks held by their respective owners

This website is not intended for viewing or usage by European Union citizens.

168 thoughts onU.S. Bank Overdraft Class Action Settlement Preliminarily Approved

Same for me us bank calked my mom say I g they will be at my hs to serve me papers between 1and 3pm feb 1 2018 regarding civil law suit from a closed us account 2009 wtf I don’t owe them shit

Did they come? They called from ORG stating I would be served papers today after I paid the assholes. That was in 09’ and I know longer have the confirmation #’s. Should I pay?

I’m trying to find out whether I racked a settlement and how to claim it

That is not what I said. I asked if I was to get a settlement how would I claim it. Since moving from th to mo.

I’ve never received anything…except notice that someone had changed my mailing address…..

I closed my account in 2009. I received a phone call TODAY from my ex husband whom I have been divorced for 16 years,but is still one of my emergency contacts….how they know, no clue, telling me Someone from MY County, with a CASE # IS trying to contact me. My discombobulated ass calls and it’s THEM, TELLING ME I OWE $1600.00!!!!! WTF??? FROM WHEN?? WHAT?? Anyone have any Suggestions, Other than what I’ve Already done, Told Ms. Annabelle to F’off….Oops? frustrated Ohioian

I already have a debt collector harassing me for $1200 to settle out of court regarding my overdrafted account that fits the timeline for this lawsuit. I know I’ll never see a dime and this is outrageous. I close my account in 2009.

They keep doing it too even after this class action suit. They hold the deposits for so long that my checks bounce and I’m broke already. In this day and age of rapid technology, they can’t get a deposit in as fast as they take a debit out? Give me a break. It’s plain STEALING. It is nice that people before me get a settlement. Obviously it isn’t stopping them from stealing from consumers three years later. They think they are above the law and they know we are powerless. It’s still going on and since there’s no specific law that says they can’t, doesn’t sound like ethics to me! They call themselves an ethical company on their website and I fell for it. That’s certainly false advertising! I work hard for my money. I entrusted my bank to take care of it for me and they were the thieves. I am so disappointed. You can’t even trust your little retirement check to be safe. Sickening.

This just happened to me! I deposited more than enough money to cover expenses, but they held it and charged me SIX overstaffed charges! So though I spent less than I deposited, I am now in the negative and can’t pay my bills! Someone help!

I am trying to find out if my check was cashed by my son and daughter-in-law while I was in a treatment program!

I have recently had the same thing happen to me. Now a collection agency has contacted me wanting to settle for half. Except I started taking screen shots on my phone from my online banking account. The banker I spoke to was looking at her computer and said her information did not match mine. She tired to tell me a 500 cash withdrawal came out after all this other stuff did even though i showed her my receipt said 8.00 am and the debit transactions showed nine pm. long story short they moved my stuff around and it then didn’t match my receipts available funds which were correct. I DIDNT KNOW THIS CLASS ACTION suit had been going on I said to the banker what they were doing is illegal. My rent never got paid because i then went neg. 1400.00 I my account wasn’t matching theirs she said when your direct deposit had gone into the bank I was already neg 1400. I said then why was all the us bank atms and online banking aps showing i was positive. I was able to pull out 800. dollars total off my card even though it was neg 1400. and not showing me Im not a lawyer but something seems wrong with this picture. not. . In out at least $4000.00 right now due to this. I went to us bank in different town to talk to someone. Cause I had a receipt showing when my deposit would be available. They ran my rent check though while leaving my 1800. deposit pending even though it said it would be posted to my account on my us ATM bank receipt said. So meaning available. My account was screwed up from july till i finally told my husband enough they are getting 300-500 every payday. Time to take your direct deposit somewhere else. I left the account and ignored there phone calls . I think something needs to be done about what they are still doing to people.

could always start a new class action suet for not honoring there settlement to every one they screwed they did this to me for yours even holding off the balance showing positive available balance so I would think I had enough then they would drop the bomb on my head for hundreds of dollars they would over draft me like this at least once or twice a year, they also would refuse to block or stop money taken by places I said to stop taking money out of my account, treating me like I am a criminal for letting places free range on my money that they are suppose to keep safe, now they give me monthly charges for having an account with them, as they increased the direct deposit to an amount any one on ssi would have to pay for the account, and they did it without any contract written or implied of me agreeing to change my account so they could charge me

I never received a check and sent a letter to the settlement administrator to get my check remailed, or resent to me and still havent received it. This is awful how thhe heck people get messed over and treated.