Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

The July 29 decision by U.S. District Judge James Lawrence King comes nearly a year after U.S. Bank agreed to pay $55 million to settle three class action lawsuits pending in the massive multidistrict litigation (MDL), known as In re: Checking Account Overdraft Litigation, involving more than 30 different banks nationwide.

The class action settlement resolves allegations that U.S. Bank posted debit card transactions to consumer deposit accounts from highest to lowest dollar amount instead of the order in which they were made. Plaintiffs claim that, instead of declining transactions when an account had insufficient funds to cover a purchase, U.S. Bank authorized the transactions and reordered their posting to increase the number of overdraft fees charged to customers.

Class Members of the U.S. Bank overdraft settlement include anyone who had a U.S. Bank consumer deposit account that could be accessed with a U.S. Bank debit card during the applicable Class Period and who were charged one or more overdraft fees as a result of the bank’s improper debit posting policy.

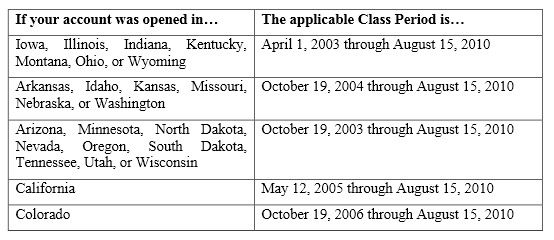

The applicable Class Period depends on the state where your U.S. Bank deposit account was opened:

The amount of money you can receive from the U.S. Bank overdraft settlement will depend on the number of overdraft fees you incurred. Only a small percentage of all overdraft fees that were charged by U.S. Bank were affected by high to low posting. So, not every overdraft fee that was charged is eligible for payment under this class action settlement.

Payments will be automatically credited to your U.S. Bank account or (if you no longer have that account) by check mailed to the address U.S. Bank has on file. There is no claim filing process.

More information on your rights in the U.S. Bank Overdraft Class Action Lawsuit Settlement can be found at www.USBankOverdraftSettlement.com. [Editor’s Note: this website was not yet active at time of publication.]

A Final Approval Hearing is scheduled for December 18, 2013.

UPDATE 1/2/14: The Settlement Administrator has posted the following update:

The Final Approval Hearing was held on December 18, 2013. Following the presentations of counsel, the Court announced its intention to grant Final Approval to the Settlement, to award Service Awards to the twelve (12) named Plaintiffs, and to award Class Counsel attorneys’ fees equal to thirty percent (30%) of the Settlement Fund plus reimbursement of certain expenses. The Court has not yet entered a Final Approval Order and Final Judgment. This website will be updated again as soon as the Final Approval Order and Final Judgment are entered by the Court.

The case is In re: Checking Account Overdraft Litigation, Case No. 1:09-md-02036, in the U.S. District Court for the Southern District of Florida.

UPDATE: 2/20/14: The Settlement Administrator has posted the following update:

On January 6, 2014, the Court granted Final Approval to the Settlement, and on January 15, 2014, the Court entered Final Judgment. In the event there are no timely appeals, the Effective Date will be February 24, 2014, and distribution of awards to eligible Settlement Class Members by account credit for current customers or by mailed check for former customers will occur no later than June 24, 2014. This site will continue to be updated as specific dates and details regarding distribution become available.

ATTORNEY ADVERTISING

Top Class Actions is a Proud Member of the American Bar Association

LEGAL INFORMATION IS NOT LEGAL ADVICE

Top Class Actions Legal Statement

©2008 – 2024 Top Class Actions® LLC

Various Trademarks held by their respective owners

This website is not intended for viewing or usage by European Union citizens.

168 thoughts onU.S. Bank Overdraft Class Action Settlement Preliminarily Approved

Has anyone received their settlement check yet? The above statements say they will be mailed by June 24th 2014.

“UPDATE: 2/20/14: The Settlement Administrator has posted the following update:

On January 6, 2014, the Court granted Final Approval to the Settlement, and on January 15, 2014, the Court entered Final Judgment. In the event there are no timely appeals, the Effective Date will be February 24, 2014, and distribution of awards to eligible Settlement Class Members by account credit for current customers or by mailed check for former customers will occur no later than June 24, 2014. This site will continue to be updated as specific dates and details regarding distribution become available.”

Please update this post if you receive a check or direct deposit reimbursement, I would like to know if anyone with my similar treatment gets money back. I have been with US Bank for a few years now, and they consistently took out the larger dollar amount pending items prior to smaller amount items so that I would owe more overdraft fees. So, based on the circumstances, I should be receiving payment. I still have not received anything in the mail saying I was included in the settlement nor has my current US Bank account has not been credited.

Note: I have not received anything in the mail AFTER the final settlement was declared. I did receive the postcard stating I was within the applicable class period.

I also received a postcard last year stating I was within the applicable class period. To date, my account has not been credited nor have we received anything in the mail. It is now 2 days past the June 24 deadline.

There was an appeal filed in January so we all have to wait till it’s over and done with to get our settlement. Could be years the way the courts work, also the 55 mil, is only about 11% if what’s owed and the lawyer’s get 33% of that so indivually we would only get a fraction of what was stolen from us to begin with, don’t know what the appeal is about, but hopefully it’s for the full amount owed and not such a small percentage.

to: TOP CLASS

CAN YOU GET INFO ON THE APPEAL US BANK SUBMITTED ON 30 JAN 2014?

Has anybody been sent to collections by US BANK?? What happened and what did you do?? From December of 2007 to July 2008; I paid nearly $5000.00 in “overdraft fee’s” to US Bank. I stopped banking with them when I realized that there was no end in sight…. “extended overdrawn fee’s” on top of the overdraft fee’s, etc. My account was $800.00 overdrawn when I opened a new account with a new bank and just walked away from them…. Trust me… I have no bad feelings about it and if I was so bad with my checking account then how is it that I have had no problems since I left US Bank… 7 years ago…. But, now I am facing a collector in court who wants me to pay him the $800.00 that US Bank states that I owe them!!! HA!

I received a check for $32.47 and I hope the hell that is what was left over after they paid themselves for the negative balance that I left them with. Does anybody have know where we can get more information as to how they figured our own personal settlement amounts? I would like to see a summary of how they came up with $32.47 out of the $5000.00 they stuck me for.

Ok I’m also out of alot of money that I had 2 pay back due 2 overdraft fees. I have moved but recieved the postcard so I can assume my address is on file I hope.

I recieved a post card from Us bank and it said we where for sure getting some $ from settlement. But I was wondering when they where gonna start sending checks out. And we dont have the same address anymore. Hope it will forward to us.

When do we get reimbursement from USB ank! I paid too much lately…. Pls let me know ASAP…

I was a former customer at us bank had to switch banks because they kept charging me over draft fees when I had money in my account so I got feed up and switched accounts never ever had that problem with my new bank!!!!!!

write my e-mail

How do I find out if I have money coming to us? Where do I check it out at?

I was a former customer at us bank had to switch banks because they kept charging me over draft fees when I had money in my account so I got feed up and switched accounts never ever had that problem with my new bank!!!!!!