Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

This settlement is closed!

Please see what other class action settlements you might qualify to claim cash from in our Open Settlements directory!

UPDATE: The Grange Insurance Total Loss Class Action Settlement was granted final approval on December 30, 2020. Let Top Class Actions know when you receive a check in the comments section below or on our Facebook page.

Grange Insurance Co. has agreed to resolve breach of contract claims against it in a total loss settlement. The deal will provide cash payments to eligible consumers to compensate them for sales tax, service fees, transfer fees and titles fees they may not have received from total loss payments.

The total loss settlement benefits Ohio individuals who were insured by Grange and submitted an auto insurance claim between May 27, 2004, and July 22, 2020, for individuals insured by Grange Indemnity Insurance Co., or between June 9, 2005, and July 22, 2020, for individuals insured by Grange Insurance Co. (formerly Grange Mutual Casualty Co.), Grange Property and Casualty or Trustgard Insurance Co.

Plaintiffs in the total loss class action lawsuit alleged Grange Insurance and its subsidiaries failed to properly pay total loss payments to their policyholders. Allegedly, these payments failed to compensate policyholders for various fees and sales tax.

A vehicle is declared a total loss when the damage after a collision is over a certain threshold, varying by state. In these situations, insurance companies like Grange offer a total loss settlement to policyholders.

Although variation in total loss payments is typical due to differing policy terms, plaintiffs in the Grange class action lawsuit argued the insurance company violated the terms of its own policies by failing to provide payments for sales tax, service fees, transfer fees and titles fees.

Grange did not admit any wrongdoing but agreed to settle the case against it in a total loss class action settlement. Under the terms of the total loss settlement, Class Members can collect a cash payment compensating them for sales tax, service fees, transfer fees and titles fees.

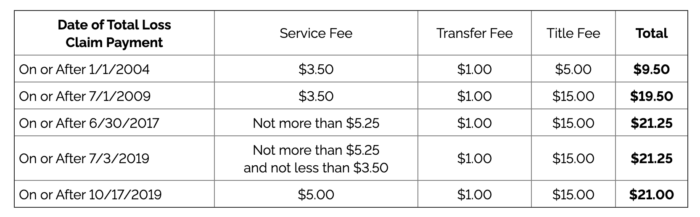

Sales tax payments will be made at Ohio’s average sales tax rate of 7.1%. Payments for service fees, transfer fees, and title fees will depend on the date of the original total loss payment and may range from $9.50 to $21. More information about how service fees, transfer fees and titles fees will be paid is available in the “Potential Award” section below.

Class Members who wish to benefit from the settlement must file a valid claim form by Dec. 31, 2020. A claim number and notice ID may be found on the notice sent to Class Members and used to file an online claim. Claim forms can also be printed from the settlement website and submitted through the mail.

The deadline for exclusion and objection was Nov. 1, 2020. The final approval hearing for the settlement is scheduled for Dec. 1, 2020.

Who’s Eligible

Ohio residents who were insured by Grange and submitted an auto insurance claim between May 27, 2004, and July 22, 2020, for individuals insured by Grange Indemnity Insurance Co., or between June 9, 2005, and July 22, 2020, for individuals insured by Grange Insurance Co. (formerly Grange Mutual Casualty Co.), Grange Property and Casualty or Trustgard Insurance Co.

Potential Award

Cash payments between $9.50 and $21, depending on the date of the total loss payment, plus sales tax.

Sales tax payments will be made at Ohio’s average sales tax rate of 7.1%. Payments for service fees, transfer fees and title fees will be distributed as follows:

Proof of Purchase

N/A

Claim Form

NOTE: If you do not qualify for this settlement do NOT file a claim.

Remember: you are submitting your claim under penalty of perjury. You are also harming other eligible Class Members by submitting a fraudulent claim. If you’re unsure if you qualify, please read the FAQ section of the Settlement Administrator’s website to ensure you meet all standards (Top Class Actions is not a Settlement Administrator). If you don’t qualify for this settlement, check out our database of other open class action settlements you may be eligible for.

Claim Form Deadline

12/31/2020

Case Name

Ostendorf v. Grange Indemnity Insurance Co., et al., Case No. 2:19-cv-01147-ALM-KAJ, in the U.S. District Court for the Southern District of Ohio

Final Hearing

12/1/2020

Settlement Website

Claims Administrator

Grange Class Action

c/o JND Legal Administration

PO Box 91307

Seattle, WA 98111

info@ohioautolosstaxsettlement.com

(877) 313-0201

Class Counsel

Jeff Ostrow

Joshua Levine

KOPELOWITZ OSTROW P.A.

Stuart Scott

SPANGENBERG SHIBLEY & LIBER LLP

Andrew Shamis

SHAMIS & GENTILE P.A.

Rachel Dapeer

DAPEER LAW

Scott Edelsberg

EDELSBERG LAW

Defense Counsel

Rodger L. Eckelberry

BAKER & HOSTETLER LLP

Read About More Class Action Lawsuits & Class Action Settlements:

ATTORNEY ADVERTISING

Top Class Actions is a Proud Member of the American Bar Association

LEGAL INFORMATION IS NOT LEGAL ADVICE

Top Class Actions Legal Statement

©2008 – 2024 Top Class Actions® LLC

Various Trademarks held by their respective owners

This website is not intended for viewing or usage by European Union citizens.

13 thoughts onGrange Insurance Total Loss Class Action Settlement

I filed a claim before the deadline for the class action lawsuit against Grange ins. I have not received any further information. My car was deemed a total loss. The estimate from the collision was $1800. Grange would not provide myself and the collision company willing to repair the work a breakdown of the cost of the repairs by grange. We requested it 14 times. Grange would only state there was hidden damage when there was clearly none. I would like someone from the class action law team to reach out to me and let me know where I stand with the lawsuit, please.

Yes it was a denial, I lived in Ohio and used Grange a while back. Probably since it’s been so long they wanted documentation.

Receiving something in the mail today in IL. Will update once received!

Since this is for Ohio residents only, it’s a denial.

Please add me to the list.

Hi Robert,

You need to go to the settlement website and submit your claim: https://www.ohioautolosstaxsettlement.com/

Please add me

Hi Lisa,

You need to go to the settlement website and submit your claim: https://www.ohioautolosstaxsettlement.com/

Add ME.

Hi Robert,

You need to go to the settlement website and submit your claim: https://www.ohioautolosstaxsettlement.com/

Hi Kevin,

You need to go to the settlement website and submit your claim: https://www.ohioautolosstaxsettlement.com/

Please add me

Hi Doncella,

You need to go to the settlement website and submit your claim: https://www.ohioautolosstaxsettlement.com/