Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

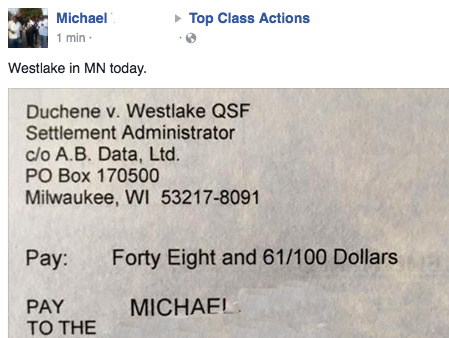

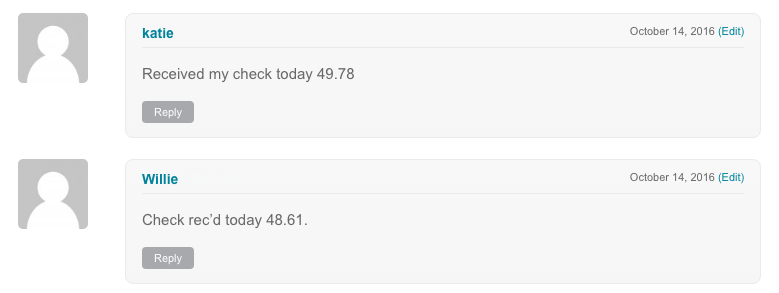

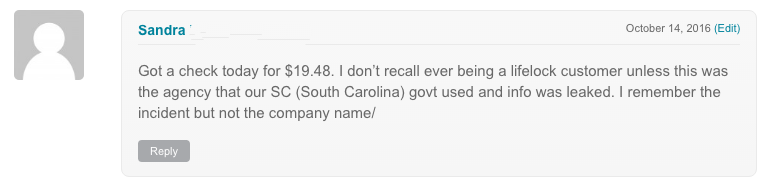

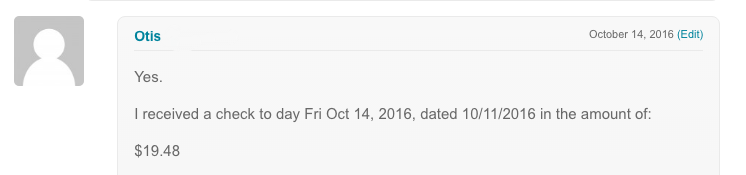

According to comments and posts on the Top Class Actions Facebook page, Class Members who submitted timely and valid claims for the Westlake Financial settlement began receiving checks worth as much as $48.61 and those who filed for the LifeLock settlement began receiving checks worth as much as $19.48 on Oct. 14, 2016.

If you filed a claim for either the Westlake or LifeLock class action settlements, keep an eye on your mailbox because checks are on their way!

The Westlake Financial class action settlement resolves allegations that the company used an automatic telephone dialing system to place robocalls to cell phones in violation of the Telephone Consumer Protection Act.

Class Members included “All persons to whom Westlake, its agents and/or its independent contractors between January 11, 2012, and November 7, 2013 placed a telephone call using an automatic telephone dialing system or an artificial or prerecorded voice to the person’s cellular telephone in connection with the confirmation of a loan applicant’s references.”

Westlake denied the claims but agreed to pay $10 million to avoid the cost of further litigation.

The deadline to file a claim for the Westlake TCPA settlement passed on June 21, 2016.

The Westlake plaintiffs are represented by Stephen F. Taylor and Sergei Lemberg of Lemberg Law LLC. (Note: Lemberg Law LLC is only representing the Westlake Class, they are NOT counsel for the Lifelock settlement)

The LifeLock class action settlement resolved allegations that the identity theft protection company failed to keep its promise of continuous security.

Specifically, the plaintiffs alleged LifeLock falsely advertised the following promises to its customers:

- Comprehensive services in detecting fraud

- Timely and continuous alerts of potential fraud 24-hours a day, every day of the year

- Keep customers’ personal data (credit card, social security, and bank account numbers) secure

- A “$1 Million Total Service Guarantee,” which provides insurance up to $1 million against identity theft

- LifeLock denied the allegations but agreed to pay $68 million to end the class action lawsuit.

Class Members included individuals who had a LifeLock identity theft protection plan at any time between Sept. 1, 2010 and Jan. 20, 2016.

Subclass Members included those who enrolled in a LifeLock identity theft protection plan between Jan. 1, 2012 and Apr. 30, 2015.

The deadline to file a claim for the LifeLock settlement passed on Apr. 29, 2016. Subclass members were not required to file a claim to receive a portion of the class action settlement.

LifeLock plaintiffs are represented by Joseph Henry Bates, III and Randall K Pulliam of Carney Bates & Pulliam PLLC; RoseMarie Maliekel and Michael W. Sobol of Lieff Cabraser Heimann & Bernstein LLP.

Congratulations to our Top Class Actions readers who submitted a valid claim and got PAID! If you missed out, sign up for our free newsletter to receive updates on new class action lawsuits and settlements. You can also check out which class action settlements are still accepting claims in our Open Class Action Settlements section.

The Westlake Financial TCPA Class Action Settlement is Duchene v. Westlake Financial Services LLC, Case No. 13-cv-01577, in the U.S. District Court for the Western District of Pennsylvania.

The LifeLock False Advertising Class Action Settlement is Ebarle, et al. v. LifeLock Inc., Case No. 3:15-cv-00258-HSG, in the U.S. District Court for the Northern District of California.

UPDATE: On March 3, 2017, Top Class Actions viewers started receiving a second round of LifeLock settlement checks worth as much as $134.04!

ATTORNEY ADVERTISING

Top Class Actions is a Proud Member of the American Bar Association

LEGAL INFORMATION IS NOT LEGAL ADVICE

Top Class Actions Legal Statement

©2008 – 2024 Top Class Actions® LLC

Various Trademarks held by their respective owners

This website is not intended for viewing or usage by European Union citizens.

96 thoughts onWestlake, LifeLock Class Action Settlement Checks Mailed

Westlake is still doing this to me who can I contact about it they call me everyday I asked them to take me of the list and got a call the next morning after telling the lady it’s harassment.

I didn’t receive a check…… I did fill out a form before the deadline …how do I check into this??

UPDATE: On March 3, 2017, Top Class Actions viewers started receiving a second round of LifeLock settlement checks worth as much as $134.04!

Are there going to be any more checks forthcoming?

I received my check for $19.48 and deposited in my bank account. I just received a letter from my bank that this check had a stop payment and the funds were debited from my account along with a $12.00 return check fee. Why is the being stopped and I am now having to pay for this!!! Help!!!

This happened to me too! My bank charges $30 for a returned check. Why is that my fee?

The checks were all dated 10/11/2016 and were only good for 120 days, February 8, 2017 was exactly 120 days. You need to contact SIGNATURE BANK to have a replacement check reissued and ask that they include the additional fees charged to you by your bank, you will likely need some verification of this from your bank as each bank charges a different amount for returned checks and they’ll want proof that you were in fact charged at all.

Same thing happened to me with both checks for myself and my husband, I’m contacting Signature Bank to have both reissued. They could have honored the checks beyond the 120 days, they simply chose not to.

Do you have a contact number for Signature Bank to get a replacement check. That would be a great help. Thank you

Hello I haven’t never did business with Westlake and I’m finding out they said I have a repo but how

I received a 4″ by 6″ card with check, from Ebarle vs. Lifelock settlement. 134.06. Deposited in my checking acct. Has not cleared, my financial inst. says there is a 3 day hold.?

Did your check clear without any problems? I received a check in the mail today but wanted to research it before depositing.

Just saw the date you posted your comment. Please let us know how it works out.

I NEED A NEW CHECK MAILED, MY CHECK WAS MAILED TO MY OLD MAILING ADDRESS AN WHEN I GOT IT ,IT WAS TO LATE TO BE CASHED SO I’M HOPEING YOU’LL MAIL ME ANOTHER ONE AT 227 W.BRECKINRIDGE ST. APT. 310,LOUISVILLE KENTUCKY 40203.. THANK BYRON S. SHACKLETT SR.

You’ll need to contact the settlement administrator with your request for a check reissue. Good luck!

You ain’t getten jack, now.

This is just a forum listing class action suits and status, this is not monitored by attorneys representing any parties of the lawsuit. If the settlement check you received is dated more than 120 days ago, you should be able to contact Signature Bank and request a replacement be issued to you and confirm your correct mailing address. They can verify that the previous check issued to you had not been cashed. If you have a problem getting them to do that, then you’ll need to contact the attorney on record for Lifelock and go from there about having it re-issued.

Do we report the 19.48 from lifelock class Action settlement on our federal income taxes?

Most class action settlements that are not medical or injury related are considered taxable. However, you should contact a tax professional to confirm this. Good luck!

Hi I have been waiting since berfore Christmas stating they were going to resend a check and I still have not received it. wanting to know what is going on.

You’ll need to contact the settlement administrator or class counsel with your questions on the status of your claim. Good luck!

My bank refused the check for lack of any routing numbers. , front or back. I don’t know how to argue that. Makes sense to me. I believe administrators did this to frustrate most people into not cashing them and pocketing the cash themselves.