Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

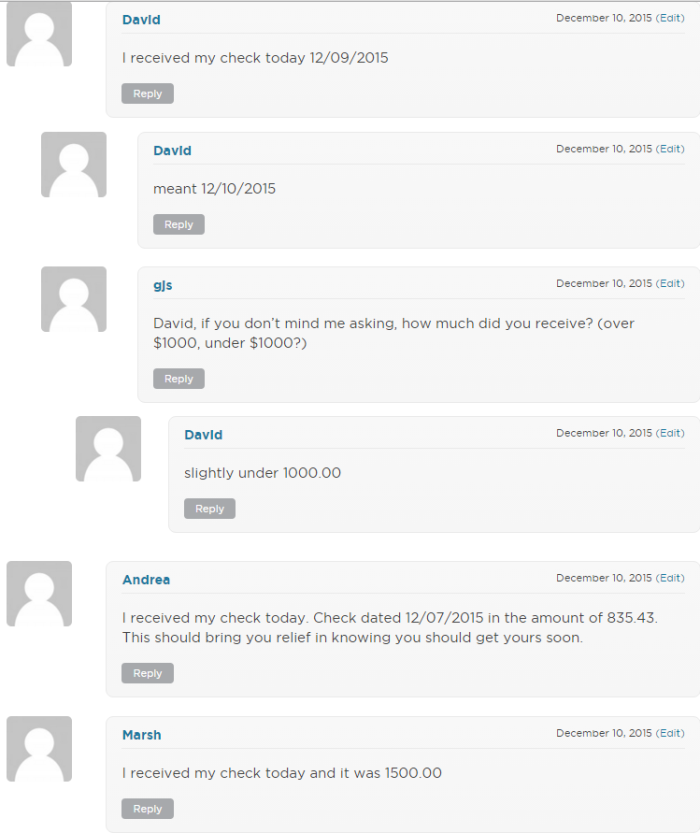

According to reader comments on the HSBC Bank force-placed insurance settlement page, claimants began receiving checks in the mail on Dec. 10, 2015. One reader has reportedly received a check worth $1,500!

The HSBC force-placed insurance class action settlement resolves allegations HSBC and Assurant Inc. forced excessive and expensive insurance policies onto homeowners in order to reap extensive profits. Although it is not illegal for a bank or mortgage lender to force-place an insurance policy on properties they finance when a homeowner’s insurance policy lapses, the loan provider is not allowed to charge more than what is necessary to insure the home.

Plaintiff Darlene Diaz filed the force-placed insurance class action lawsuit against HSBC and Assurant in March 2013, alleging that the companies force-placed insurance policies on homeowners in order to obtain an unauthorized benefit.

HSBC and Assurant deny the allegations and assert they did not violate the law with regard to their force-placed insurance practices. However, they agreed to settle the class action lawsuit to avoid the cost and risk of trial. The force-placed insurance settlement received final approval on Oct. 29, 2014.

Class Members of the HSBC force-placed insurance settlement include all borrowers who were charged by the defendants and/or their affiliates for force-placed hazard insurance policies between Jan. 1, 2005 and March 24, 2014.

Under the terms of the HSBC class action settlement, Class Members who filed valid and timely claims were eligible to receive between 6 and 13 percent of the net premium of the force-placed insurance policy.

The deadline to file a claim for the HSBC force-placed insurance policy passed on Dec. 29, 2014.

Congratulations to our Top Class Actions readers who submitted a valid claim and got PAID! If you missed out, sign up for our free newsletter to receive updates on new class action lawsuits and settlements. You can also check out which class action settlements are still accepting claims in our Open Class Action Settlements section.

The HSBC Force-Placed Insurance Class Action Lawsuit is Lopez v. HSBC Bank USA NA, Case No. 1:13-cv-21104, in the U.S. District Court for the Southern District of Florida.

ATTORNEY ADVERTISING

Top Class Actions is a Proud Member of the American Bar Association

LEGAL INFORMATION IS NOT LEGAL ADVICE

Top Class Actions Legal Statement

©2008 – 2024 Top Class Actions® LLC

Various Trademarks held by their respective owners

This website is not intended for viewing or usage by European Union citizens.

3 thoughts onHSBC Bank Force-Placed Insurance Settlement Pays Out

I never received the info and insurance was forced on my HSBC mortgage. This ca not be legal since I have lived at the same address since 1987 and HSBC was my mortgager for 2005 and 2013.

I have I phone 5 c send information about settlement thank you

I moved from Illinois to California, left Dec 10. I put in to have my mail forwarded, but no check from HSBC and it’s dec 21. I am worried the Chaco had a do not forward on it. What can I do?