Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

This settlement is closed!

Please see what other class action settlements you might qualify to claim cash from in our Open Settlements directory!

Bank of America NA has agreed pay nearly $42 million to settle a class action lawsuit over allegations it has charged thousands of military service members’ families excessive interest on certain accounts since Sept. 11, 2001, and that it has attempted to conceal these excess interest charges.

If you received or were eligible to receive additional compensation related to military reduced interest rates from Bank of America at any time on or after Sept. 11, 2001, you may be entitled to compensation from the military member fee class action settlement.

According to the BofA class action lawsuit, Bank of America charged thousands of military servicemember family customers excessive interest on mortgage accounts, credit card accounts, and other interest-bearing obligations. The plaintiffs further allege that Bank of America tried to conceal these excess interest charges and in doing so violated the Servicemembers Civil Relief Act, the Truth in Lending Act and North Carolina’s Unfair and Deceptive Trade Practices Act.

The Bank of America class action lawsuit also asserts claims for breach of contract, negligence and negligent misrepresentation.

“Since our country’s founding, members of our military services have been asked to make many sacrifices for our nation,” the Bank of America class action lawsuit says. “One of these sacrifices is financial; leaving family, friends and the comforts of civilian life to answer our country’s call to duty also requires leaving behind employment, a career, and financial security.”

The Servicemembers Civil Relief Act was enacted to address these sacrifices, and it guarantees that all debts incurred by a service member before being called to active duty are reduced to an interest rate of no more than six percent. Bank of America reportedly implemented a program that promised benefits that were more generous than those required by the SCRA in order to attract servicemembers.

“Bank of America, however, has failed to honor the active duty status of America’s fighting forces by: (1) charging an unlawfully high interest rate on the debts of servicemembers while they were abroad serving our nation, in violation of the SCRA and the Bank’s own contractual duties; (2) temporarily ‘subsidizing’ interest charges on servicemembers’ mortgages rather than re-amortizing their loans as necessary to permanently forgive interest above 6%; (3) allowing these unlawful interest charges to improperly inflate servicemembers principal balances and deprive plaintiffs of equity in their homes, equity to which they are legally entitled; and (4) charging compound interest on those inflated balances.”

Bank of America denies the allegations but agreed to settle the military member service fee class action lawsuit to avoid the costs and uncertainty of trial. The Bank of America class action settlement was preliminarily approved on Sept. 13, 2017.

Class Members who would like to opt out of or object to the Bank of America military member service fee settlement must do so no later than Dec. 12, 2017.

Who’s Eligible

Class Members of the Bank of America settlement include: “All persons identified in Bank of America’s records as obligors or guarantors of an obligation or account that, at any time on or after September 11, 2001, received and/or may have been eligible to receive additional compensation related to military reduced interest rate benefits from Defendant, but excluding persons who have executed a release of rights claimed in this action.”

Potential Award

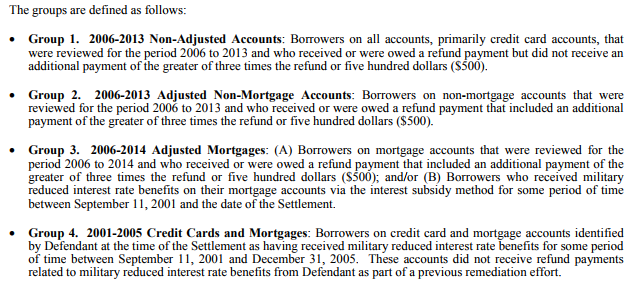

Varies, depending on the type of account, amount of time the accountholder was eligible for a refund related to military reduced interest rate benefits, whether the accountholder received a prior refund from Bank of America related to the military reduced interest rate benefits, whether the accountholder received an additional payment of three times the refund or $500 (whichever is greater), and (for mortgage accounts) the method by which Bank of America applied military reduced interest rate benefits to the account.

According to the BofA settlement website, it is not currently possible to calculate Class Members’ individual payments. Detailed information about how the settlement payments will be calculated for each group is available in the distribution section of the Bank of America settlement agreement.

Proof of Purchase

N/A

Frequently Asked Questions

NOTE: If you do not qualify for this settlement do NOT file a claim.

Remember: you are submitting your claim under penalty of perjury. You are also harming other eligible Class Members by submitting a fraudulent claim. If you’re unsure if you qualify, please read the FAQ section of the Settlement Administrator’s website to ensure you meet all standards (Top Class Actions is not a Settlement Administrator). If you don’t qualify for this settlement, check out our database of other open class action settlements you may be eligible for.

Claim Form Deadline

N/A. If you have been identified as a Class Member, you will automatically be mailed a check if the Bank of America settlement becomes final.

Case Name

Childress v. Bank of America NA, Case No. 5:15-cv-00231, in the U.S. District Court for the Eastern District of North Carolina

Final Hearing

2/5/2018

UPDATE: The Bank of America Military Member Fee Class Action Settlement was granted final approval on February 5, 2018. Let Top Class Actions know when you receive a check in the comments section below or on our Facebook page.

Settlement Website

Claims Administrator

Bank of America Military Settlement

c/o Kurtzman Carson Consultants

P.O. Box 404036

Louisville, KY 40233-4036

1-877-468-0425

info@BankofAmericaMilitarySettlement.com

Class Counsel

Steve W. Berman

Shayne C. Stevenson

HAGENS BERMAN SOBOL SHAPIRO LLP

Knoll D. Lowney

SMITH & LOWNEY PLLC

Kieran J. Shanahan

Brendon S. Neuman

Christopher S. Battles

SHANAHAN LAW GROUP PLLC

Defense Counsel

Bryan A. Fratkin

MCGUIRE WOODS LLP

ATTORNEY ADVERTISING

Top Class Actions is a Proud Member of the American Bar Association

LEGAL INFORMATION IS NOT LEGAL ADVICE

Top Class Actions Legal Statement

©2008 – 2024 Top Class Actions® LLC

Various Trademarks held by their respective owners

This website is not intended for viewing or usage by European Union citizens.

332 thoughts onBank of America Military Member Fee Class Action Settlement

Just received my checks 1 day too late to cash. Where can I go to replace checks?

I received a post card in the mail. It stated I have not cashed my check yet and that I needed to contact them if I never got one which I didn’t. I have emailed several times with no response. I also called where I learned they have my address from several years ago on file. This confuses me because they sent the postcard to the correct address. Anyway there is absolutly no way to talk to anybody or to change my address online. This all seems like a scam. What can I do?

I’m experiencing the same exact issue. The postcard advises to contact them to request a check be reissued, but doesn’t look like they are too concerned with being contacted or to help. I’m trying to find a way to get the check reissued. If I find a way to do it, I’ll post again on here.

I received a check for a very small amount, is this all I can expect? I am still trying to pay off the interest on the credit card, and the mortgage has been sold off to another bank.

I got a check today for the same amount stated above. Should I cash it or will holding out help me? I begged BofA for years during this time period and got nothing. Except, sure you can get out from under your pmu, if you pay almost $600 upfront.

I am the spouse of a military retiree, Received a check for $346.82. Will my husband receive a check also?

Is this a scam? I received a check in the mail and unsure if I should cash it or not

Received 2 checks; very nice surprise.

I received for two checks with the same amount but different claim number. Is this right? Can I cask=h both checks?