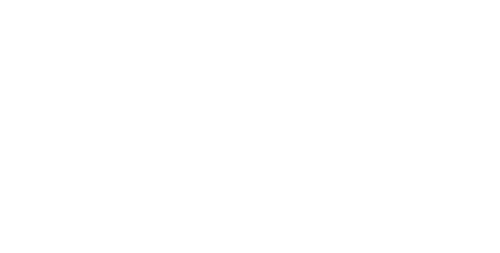

A class action lawsuit alleges that wireless service provider T-Mobile misleads customers with its credit checks.

A class action lawsuit alleges that wireless service provider T-Mobile misleads customers with its credit checks.

According to the complaint, T-Mobile informs its potential customers that it makes a “soft” credit check, meaning that it obtains their credit information without appearing on their credit history.

In reality, the class action asserts that T-Mobile performs a “hard” credit check without potential customers’ knowledge or permission, and in violation of state consumer protection laws.

The T-Mobile credit check class action lawsuit alleges that the company’s practice of doing “hard” credit checks on its potential customers can cause their credit scores to decrease. In turn, that can lead to reduced or outright denial of loans or other financing, the lawsuit states.

Plaintiff Erik Shapiro claims that on or about Feb. 5, 2014, he called T-Mobile and looked into switching cell phone providers. On that call, Shapiro says he was told by the T-Mobile representative that they would do a credit check. When Shapiro asked if it would appear on his credit history, the T-Mobile rep allegedly said no, because it was “a soft inquiry.”

The T-Mobile class action lawsuit asserts that it was not a “soft” inquiry, and did appear on Shapiro’s credit history. Shapiro states that two days later he faxed T-Mobile a letter informing them he did not agree to the credit check, and to remove it from his history.

To date, T-Mobile has not corrected Shapiro’s credit history, according to the class action complaint.

Shapiro contends that his authorization for T-Mobile’s credit check was obtained through misleading and deceptive practices, and that he would never have allowed T-Mobile to perform the “hard” credit check had he known the truth.

The T-Mobile credit check class action lawsuit alleges that T-Mobile’s conduct violates multiple California statutes, including its consumer protection laws.

The complaint argues that T-Mobile’s misrepresentations to its customers at the point of sale are an unfair and deceptive trade practice, and false advertising. In addition, providing “incomplete or inaccurate” information to a credit reporting agency is a violation of California law, according to the class action.

Finally, the complaint asserts that failing to correct inaccurate information on a credit report is a violation of federal law.

The T-Mobile credit check lawsuit requests to certify a Class of “All persons within the United States who had a hard inquiry performed on his or her credit by Defendant and such person had not previously authorized a hard inquiry” within the past four years. The class action seeks restitution, statutory damages, and a court order prohibiting T-Mobile’s unauthorized “hard” credit checks.

This is not the only consumer protection class action lawsuit currently against T-Mobile. As TopClassActions.com reported back in April, another class action alleges that T-Mobile misrepresents its “no contract” cell phone service plans. That lawsuit asserts that T-Mobile’s “no contract” plans have hidden fees, including early termination fees, in violation of state consumer protection laws.

Shapiro is represented by Todd M. Friedman, Adrian R. Bacon, Thomas E. Wheeler, and Meghan E. George of the Law Offices of Todd M. Friedman, P.C.

The T-Mobile Credit Check Class Action Lawsuit is Erik Shapiro v. T-Mobile USA Inc., Case No. 2:16-cv-04698, in the U.S. District Court for the Central District of California.

ATTORNEY ADVERTISING

Top Class Actions is a Proud Member of the American Bar Association

LEGAL INFORMATION IS NOT LEGAL ADVICE

Top Class Actions Legal Statement

©2008 – 2025 Top Class Actions® LLC

Various Trademarks held by their respective owners

This website is not intended for viewing or usage by European Union citizens.

9 thoughts onT-Mobile Class Action Filed Over Unauthorized Credit Checks

I wasn’t even asked for permission for a soft or hard pull and yet it happened

Add me

T Mobile ran an unauthorized credit check. I had two of there employee, walk into my place if employment and solicit me into buying phones from T-Mobile. I declined, I check my credit on Credit Karma and I had seen that they had ran a credit report on me which was unauthorized. This has affected my credit score which I was trying to build to purchase a vehicle.

3 hard inquiries in less than a year w/o my knowledge or consent

I see a credit check from them on my credit report for the beginning of the year when I was already a customer, I live in Oregon, is this a California lawsuit only? Who do I need to contact?

I was told the same

Issue why ain’t contact info?

t moblie will foget to charge u tax 18.5% in oakland ca

I also was told the same story

I would like to find out more about this case. I was also told by T-Mobile they were running a soft credit check.