The State Employees Credit Union of North Carolina, which is based in Raleigh, N.C., has more than 260 branches and 1,100 ATMs across the state.

The State Employees Credit Union of North Carolina, which is based in Raleigh, N.C., has more than 260 branches and 1,100 ATMs across the state.

In fact, it’s one of the largest credit unions in the United States, though its branches are located solely in-state. Despite the popularity of using SECU, there may be hidden issues that some consumers don’t know about.

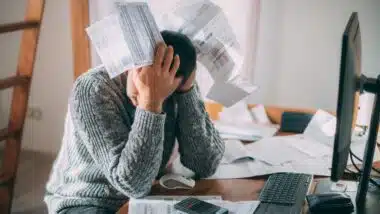

A slew of financial institutions, including the State Employees Credit Union, are currently under investigation for unfair or deceptive practices used to wring the most money possible in credit union bank overdraft fees out of customers.

If you have been hit with unfair overdraft practices from SECU or another bank or credit union, you may be able to file a credit union bank overdraft fees lawsuit and pursue compensation.

Overdraft Fee Basics

Essentially, an overdraft fee is charged when a person overdraws their account. Instead of hitting the bottom of their account and being unable to make the transaction, if the consumer has signed up for their financial institution’s overdraft protection program, the transaction is processed and the overdraft fee required in exchange to move money and cover the payment.

Overdraft fees may compound—that is, each time an account is pushed further into overdraft, a new overdraft fee is charged.

Unfortunately, some banks and credit unions may take advantage of this system, using unfair practices to charge excessive fees.

Common Deceptive Overdraft Practices

There are a number of deceptive or unfair overdraft practices that banks and credit unions can use to charge you more fees, more often.

Generally when you make purchases, you expect that your bank or credit union will process those transactions chronologically—as in, in the order in which they were made. However, some institutions may have a policy of reordering transactions to their best advantage, in an order that would incur the most overdraft fees to stack on top of each other.

Indeed, banks can reorder transactions from largest to smallest, which makes each following payment more likely than the previous to overdraw the account, making it so that the most overdraft fees possible will compound and lead to a larger amount in overdraft fees charged.

A technological advancement that has helped a lot of people stay on top of their finances, enabling them to check their balance at the drop of a hat, is that bank account balances are available online.

However, some consumers have found themselves unexpectedly overdrawing their account, even with their online account balance showing they had sufficient funds to make the transaction. This is because not all pending transactions are visible via online accounts, so the actual funds available may be different, leading you to overdraw your account.

Filing a Banks Overdraft Fees Lawsuit

Have you noticed these or other unfair or deceptive overdraft practices from the State Employees Credit Union of North Carolina or another bank or credit union?

You may be able to file a credit union banks overdraft fees lawsuit and pursue compensation. Other financial institutions being investigated include HSBC Bank, UMB Bank, Boeing Employees Credit Union, Star One Credit Union, and others.

Consulting an experienced attorney can help you determine if you have a claim, navigate the complexities of litigation, and maximize your potential compensation.

If you were charged overdraft fees or NSF fees by your bank or credit union that you believe are improper for any reason, the attorneys who work with Top Class Actions are ready to investigate these fees on your behalf.

Learn more by filling out the form on this page.

This article is not legal advice. It is presented

for informational purposes only.

ATTORNEY ADVERTISING

Top Class Actions is a Proud Member of the American Bar Association

LEGAL INFORMATION IS NOT LEGAL ADVICE

Top Class Actions Legal Statement

©2008 – 2025 Top Class Actions® LLC

Various Trademarks held by their respective owners

This website is not intended for viewing or usage by European Union citizens.

Get Help – It’s Free

Join a Free Bank Overdraft Fee Class Action Lawsuit Investigation

If your bank and credit union has engaged in deceptive overdraft fee practices, you may have a legal claim. Fill out the form on this page now to find out if you qualify!

An attorney will contact you if you qualify to discuss the details of your potential case.

PLEASE NOTE: If you want to participate in this investigation, it is imperative that you reply to the law firm if they call or email you. Failing to do so may result in you not getting signed up as a client or getting you dropped as a client.

In order to properly investigate overdraft fee claims, you may be required to disclose bank statements to overdraft fee attorneys. Please note that any such information will be kept private and confidential.

State employess credit union has been charging me for a long time I had 11 nsf this month alone I need help