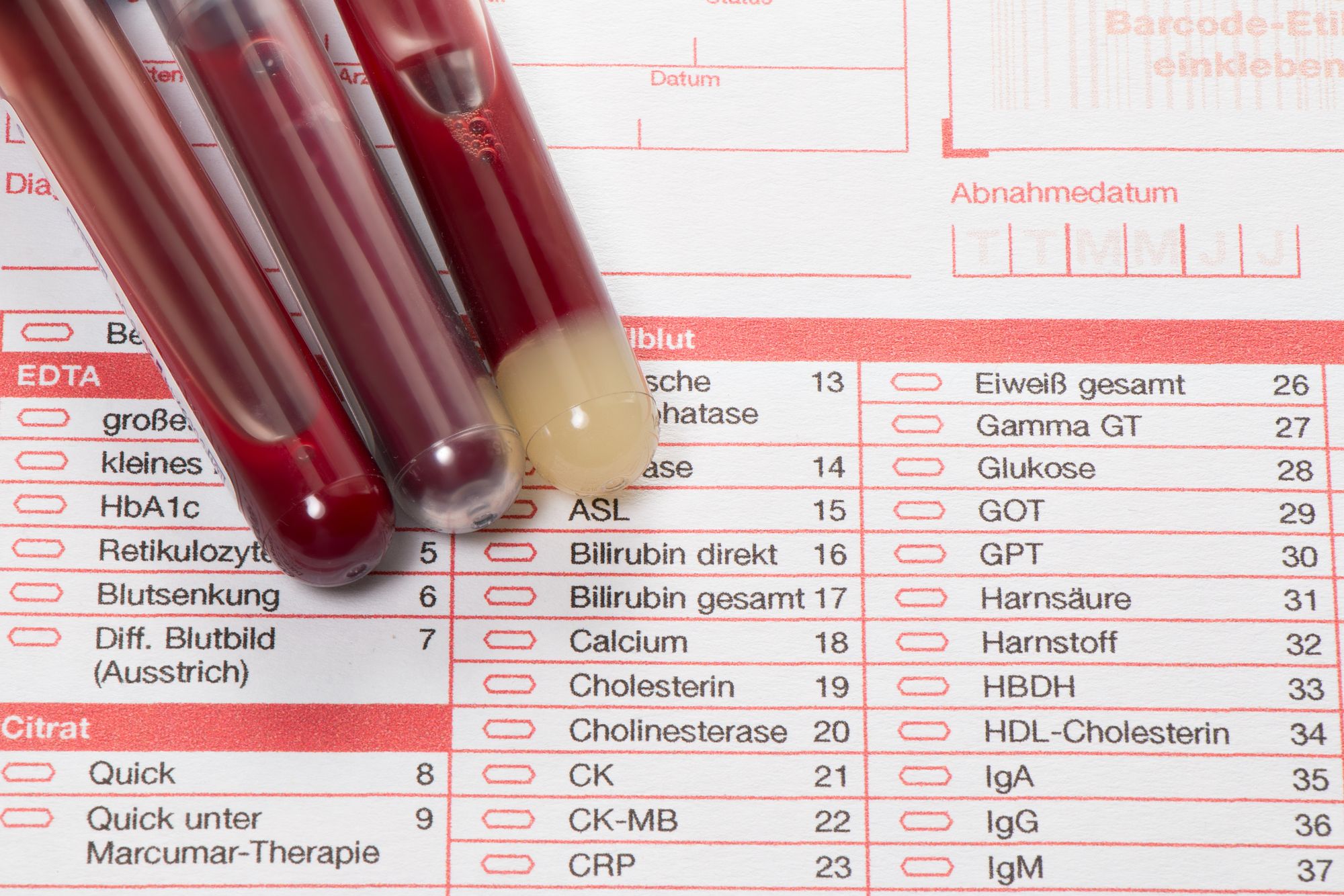

Many patients are surprised when they receive their medical bills in the mail because of hidden costs they were unaware of including exorbitant lab tests costs not covered by insurance.

Many patients are surprised when they receive their medical bills in the mail because of hidden costs they were unaware of including exorbitant lab tests costs not covered by insurance.

Sometimes insurance companies may not cover certain lab tests that a physician deems important. If an insurance company thinks a test is unnecessary or experimental, then it may deny coverage.

When a patient goes to get these tests, they may be unaware that some lab tests costs are not covered by their insurance. In fact, some lab companies may be taking unfair advantage of what patients do not know.

Most of the time, labs and insurance companies have agreements that say that lab tests costs will be offered at a discounted rate. When a lab test can be billed to an insurance company, the labs offer tests at lower rates. But when an insurance company denies coverage, the lab often turns around and bills the patient a much higher rate.

Some lab companies that can be engaging in this kind of unfair price hikes include Laboratory Corporation of America, Quest Diagnostics and Bio-Reference Laboratories.

Critics claim that these lab companies charge more lab tests costs than what is fair when an insurer denies coverage and that they charge more than “fair market” prices for lab tests. They also say that companies like LabCorp maintain a price list of diagnostic lab tests that is grossly disproportionate to what is fair market value for these procedures.

They also say that sometimes, the bills from these lab companies are almost impossible to decipher and they are deceptive and misleading. Because of this, patients may not be aware of the insurance discounts or insurance payments that are being applied to each individual lab tests costs.

One such lawsuit has been filed by four individuals against LabCorp. The plaintiffs claim, among many things, that Lab Corp does not inform patients about whether certain tests are covered by their insurer or not. The patients, the plaintiffs claim, have no way of knowing if they will be required to pay the “grossly excessive rack rate” for the tests they are receiving.

For example, in 2015 one of the plaintiffs was charged nearly $800 for a series of seven tests that were not covered by insurance. He had an additional test performed which was actually covered by his insurance company for the rack rate of $39. BlueCross, the plaintiff’s insurer, paid LabCorp just $3.78 for this test.

The plaintiff in this case believes that the huge amount that LabCorp charged him for the original seven tests is unfair and he would have never agreed to the tests had he known.

You may have been overcharged for lab test costs after your insurance company denied coverage. If so, you may be entitled to legal compensation and you may qualify to file a lab test costs lawsuit.

Join a Free Medical Lab Fees Class Action Lawsuit Investigation

If you believe you were overcharged for medical lab fees after being denied coverage by your health insurance company, you may qualify to file a lab test fees lawsuit or laboratory fraud class action lawsuit.

ATTORNEY ADVERTISING

Top Class Actions is a Proud Member of the American Bar Association

LEGAL INFORMATION IS NOT LEGAL ADVICE

Top Class Actions Legal Statement

©2008 – 2025 Top Class Actions® LLC

Various Trademarks held by their respective owners

This website is not intended for viewing or usage by European Union citizens.

2 thoughts onSurprised by Lab Tests Costs?

It’s like my insurance doesn’t cover any of my labs..

Wow, I paid bills in the 400 range with insurance…. I still owe a ton. It’s severely costly and devastating.