Top Class Actions’s website and social media posts use affiliate links. If you make a purchase using such links, we may receive a commission, but it will not result in any additional charges to you. Please review our Affiliate Link Disclosure for more information.

The July 29 decision by U.S. District Judge James Lawrence King comes nearly a year after U.S. Bank agreed to pay $55 million to settle three class action lawsuits pending in the massive multidistrict litigation (MDL), known as In re: Checking Account Overdraft Litigation, involving more than 30 different banks nationwide.

The class action settlement resolves allegations that U.S. Bank posted debit card transactions to consumer deposit accounts from highest to lowest dollar amount instead of the order in which they were made. Plaintiffs claim that, instead of declining transactions when an account had insufficient funds to cover a purchase, U.S. Bank authorized the transactions and reordered their posting to increase the number of overdraft fees charged to customers.

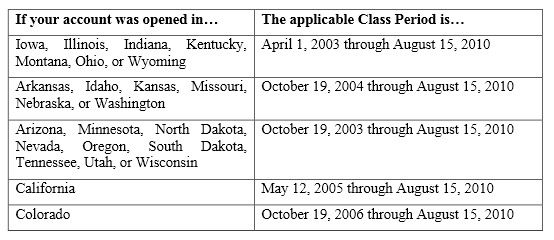

Class Members of the U.S. Bank overdraft settlement include anyone who had a U.S. Bank consumer deposit account that could be accessed with a U.S. Bank debit card during the applicable Class Period and who were charged one or more overdraft fees as a result of the bank’s improper debit posting policy.

The applicable Class Period depends on the state where your U.S. Bank deposit account was opened:

The amount of money you can receive from the U.S. Bank overdraft settlement will depend on the number of overdraft fees you incurred. Only a small percentage of all overdraft fees that were charged by U.S. Bank were affected by high to low posting. So, not every overdraft fee that was charged is eligible for payment under this class action settlement.

Payments will be automatically credited to your U.S. Bank account or (if you no longer have that account) by check mailed to the address U.S. Bank has on file. There is no claim filing process.

More information on your rights in the U.S. Bank Overdraft Class Action Lawsuit Settlement can be found at www.USBankOverdraftSettlement.com. [Editor’s Note: this website was not yet active at time of publication.]

A Final Approval Hearing is scheduled for December 18, 2013.

UPDATE 1/2/14: The Settlement Administrator has posted the following update:

The Final Approval Hearing was held on December 18, 2013. Following the presentations of counsel, the Court announced its intention to grant Final Approval to the Settlement, to award Service Awards to the twelve (12) named Plaintiffs, and to award Class Counsel attorneys’ fees equal to thirty percent (30%) of the Settlement Fund plus reimbursement of certain expenses. The Court has not yet entered a Final Approval Order and Final Judgment. This website will be updated again as soon as the Final Approval Order and Final Judgment are entered by the Court.

The case is In re: Checking Account Overdraft Litigation, Case No. 1:09-md-02036, in the U.S. District Court for the Southern District of Florida.

UPDATE: 2/20/14: The Settlement Administrator has posted the following update:

On January 6, 2014, the Court granted Final Approval to the Settlement, and on January 15, 2014, the Court entered Final Judgment. In the event there are no timely appeals, the Effective Date will be February 24, 2014, and distribution of awards to eligible Settlement Class Members by account credit for current customers or by mailed check for former customers will occur no later than June 24, 2014. This site will continue to be updated as specific dates and details regarding distribution become available.

ATTORNEY ADVERTISING

Top Class Actions is a Proud Member of the American Bar Association

LEGAL INFORMATION IS NOT LEGAL ADVICE

Top Class Actions Legal Statement

©2008 – 2024 Top Class Actions® LLC

Various Trademarks held by their respective owners

This website is not intended for viewing or usage by European Union citizens.

168 thoughts onU.S. Bank Overdraft Class Action Settlement Preliminarily Approved

They are doing it to me now they are not putting my pending transaction as my total in my account like they used to and it’s like they double charge! And then I get a bunch of over draft fees bc it isn’t showing me the right amount anymore

I was a Bank member in California for those years! I knew it was a obvious Scam back then, where do I go to get my $$$ back?

I bank with US Bank in my eligible for a refund like everyone else are